Spot Bitcoin exchange-traded funds (ETFs) are experiencing considered one of their strongest months since launching in January 2024, with inflows surpassing $3 billion to date in October.

This surge in demand has led ETF issuers to buy Bitcoin at ranges far exceeding the newly mined provide.

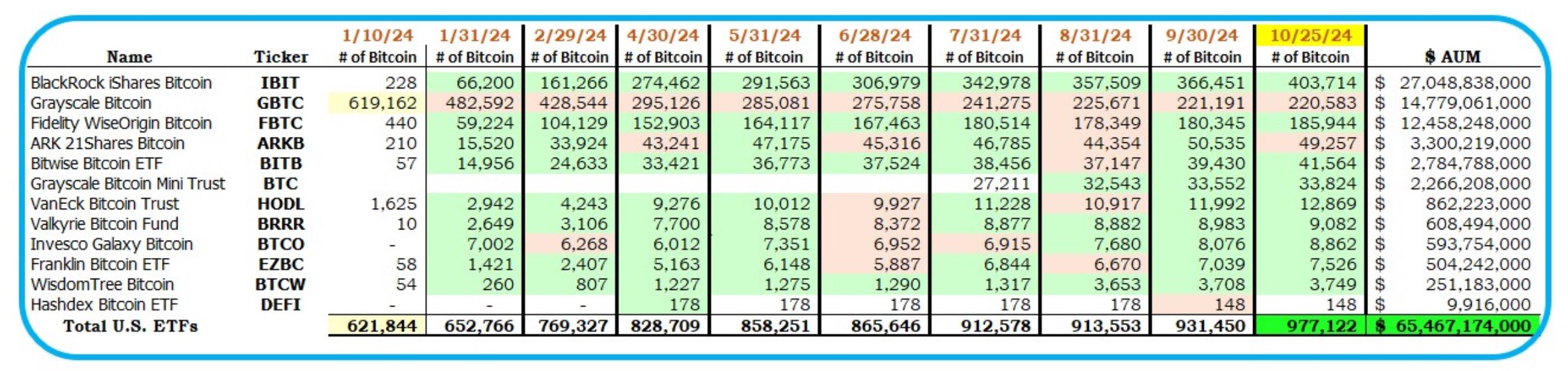

US Spot Bitcoin ETFs Amass 45,000 BTC in October

In the course of the buying and selling week of October 21-25, the 11 spot Bitcoin ETFs purchased a mixed 15,194 BTC, which is sort of 5 occasions the three,150 BTC mined in that interval, in response to knowledge from HODL15Capital. Inflows throughout this week totaled round $1.83 billion, reflecting the robust demand that has fueled unprecedented ranges of BTC acquisition by ETF issuers.

“If you happen to offered any Bitcoin right now, this week, or this yr, it’s been purchased by the ETFs. Demand for U.S. Bitcoin ETFs far exceeds new provide, however weak palms willingly promote their BTC day after day, week after week,” HODL15Capital wrote.

Learn extra: What Is a Bitcoin ETF?

Since early October, these issuers have collectively bought 45,557 BTC. That is the fourth-highest month for BTC acquisitions since spot ETFs acquired approval on January 10, 2024.

In the meantime, aggressive shopping for has introduced ETF issuers’ mixed BTC holdings shut to at least one million BTC. As of October 25, the Bitcoin ETF issuers collectively held 977,122 BTC — simply 22,878 BTC in need of the million-BTC threshold. BlackRock has the biggest BTC reserve, holding roughly 403,714 BTC, which equates to just about 2% of Bitcoin’s whole provide.

Notably, if the ETFs’ present accumulation fee continues, their mixed holdings might quickly surpass that of Satoshi Nakamoto, the pseudonymous creator of the highest asset.

“Not but 10 months outdated and the ETFs are 97% of the way in which to holding 1 million BTC, and 87% of the way in which to passing Satoshi as largest,” Bloomberg ETF analyts Eric Balchunas said.

Learn extra: Tips on how to Put money into Ethereum ETFs?

Market observers have identified that with the ETF issuers now holding a considerable portion of BTC’s provide, their affect on market liquidity and value stability is prone to develop.

Certainly, because the ETFs proceed accumulating the highest asset, there could also be higher volatility threat in periods of excessive inflows or outflows, significantly given the comparatively fastened provide of BTC. Analysts warning that such focus might result in elevated value sensitivity in response to market dynamics.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.