An analyst has argued that Bitcoin stays on observe, no matter present fluctuations, citing its cyclical patterns.

In the present day, Bitcoin’s value has skilled a notable uptick, rebounding since its dip over the weekend to surpass $69,000. This current momentum coincides with discussions about Bitcoin’s cyclical nature and the rising consideration on Bitcoin exchange-traded funds (ETFs).

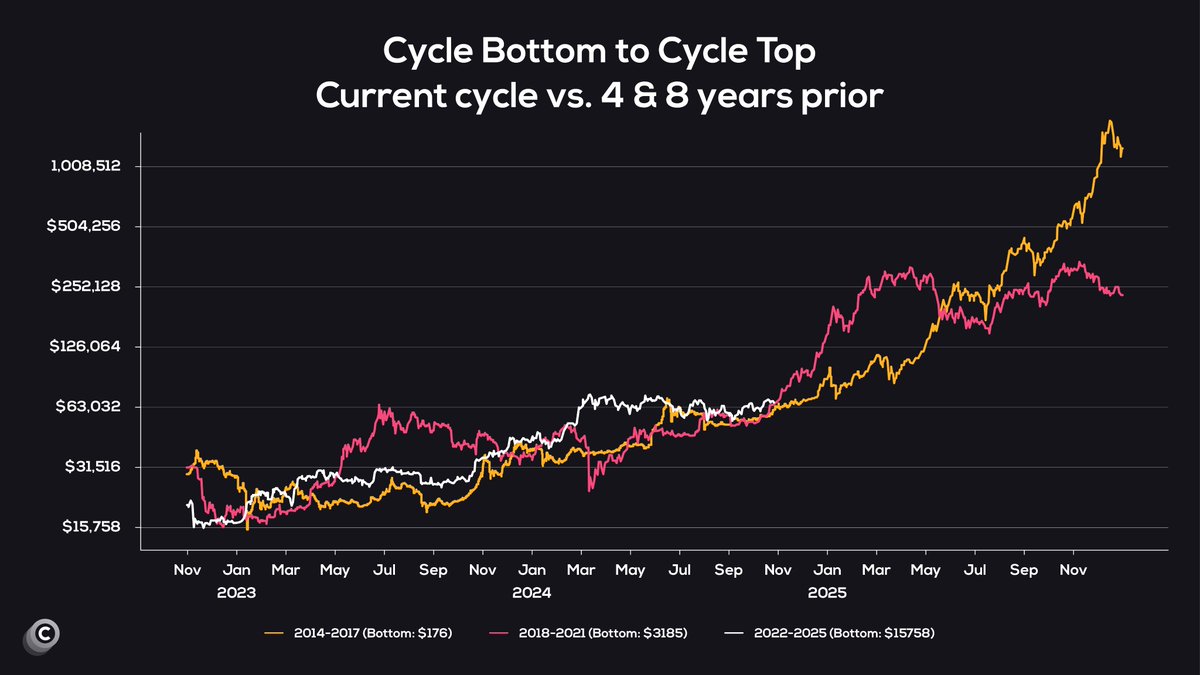

Taking to X, crypto dealer “Coinvo” pointed out a sample in Bitcoin’s value motion throughout distinct four-year cycles. These cycles have traditionally led to vital parabolic development, with every cycle marked by a backside adopted by speedy value escalation.

The 2014-2017 cycle noticed Bitcoin backside at $176, adopted by a surge, whereas the 2018-2021 cycle started at a $3,185 backside, resulting in an identical consequence. Within the 2022-2025 cycle, Bitcoin’s backside is $15,758, and the uptrend has been in progress since This autumn 2023.

The analyst’s chart means that if historic patterns proceed, one other parabolic rise may very well be forthcoming because the cycle progresses towards 2025. In the end, the analyst emphasizes that Bitcoin “is on observe” and that buyers want endurance amid the present market situations.

Bitcoin ETF Holdings Breaking Out Earlier than BTC Worth

Alongside Bitcoin’s cyclical motion, consideration has shifted to Bitcoin ETFs, the place holdings are reportedly reaching greater ranges forward of Bitcoin’s value. Particularly, a put up on X by Charles Edwards, founding father of Capriole Investments, indicated that ETF holdings have surpassed $60 billion. Notably, the surge in ETF demand is seen as an indicator of potential upward value momentum for Bitcoin.

ETF holdings are breaking out, earlier than Bitcoin value pic.twitter.com/pSzAbm8Jpp

— Charles Edwards (@caprioleio) October 28, 2024

Additional supporting this development, U.S. spot Bitcoin ETFs have not too long ago skilled their highest influx in six months. As reported by The Crypto Primary final week, these ETFs have amassed almost 65,000 BTC, equal to $4.4 billion in new capital over the previous month. Particularly, this degree of funding hasn’t been seen since April, when Bitcoin’s value exceeded $72,000.

Earlier this yr, the ETF market confronted challenges, notably in Could, when Bitcoin’s worth dipped beneath $56,000, resulting in a lower in holdings. Nevertheless, the development took a big activate September 18, spurred by a U.S. rate of interest lower that reignited investor curiosity in crypto belongings. Since then, ETF inflows have steadily elevated, reversing the prior bearish sentiment.

DisClamier: This content material is informational and shouldn’t be thought-about monetary recommendation. The views expressed on this article might embody the creator’s private opinions and don’t replicate The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding choices. The Crypto Primary shouldn’t be accountable for any monetary losses.