Investor confidence in crypto-related funding merchandise surged final week, buoyed by the US macroeconomic scenario.

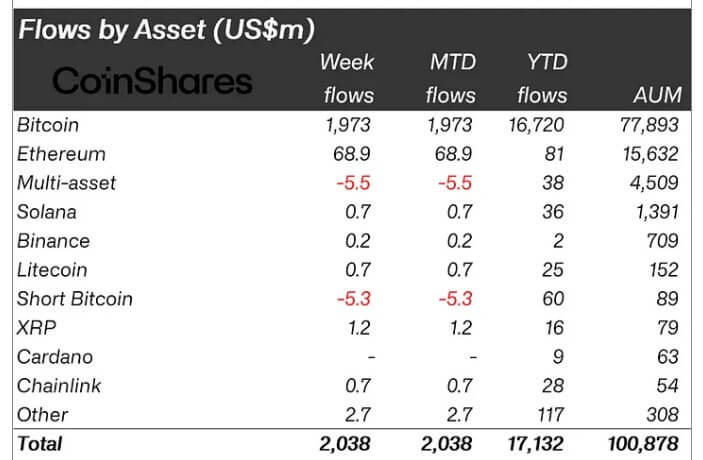

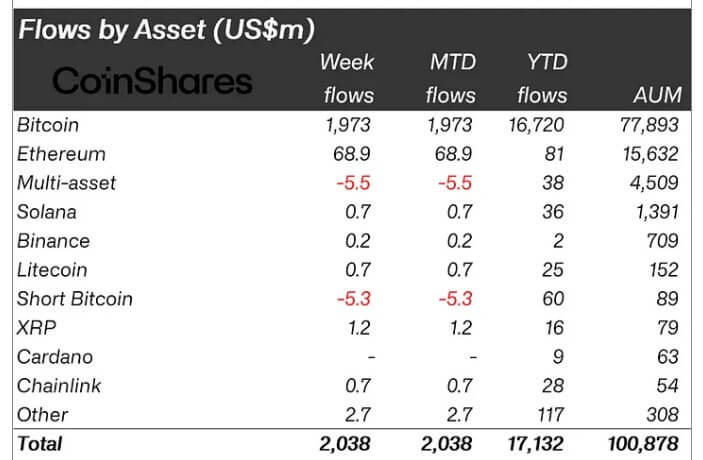

In its newest weekly report, CoinShares noticed that these monetary devices noticed internet inflows of $2 billion final week, matching the entire inflows recorded for Might.

Moreover, this marks the fifth consecutive week of optimistic inflows, with the property drawing round $4.3 billion price of investments through the interval. Notably, that is the second-longest streak of inflows because the US Securities and Change Fee (SEC) accredited spot Bitcoin exchange-traded funds (ETF) in January.

James Butterfill, CoinShares’ head of analysis, famous that inflows have been widespread throughout suppliers like BlackRock, Constancy, Proshares, Bitwise, and Objective, with a notable discount in outflows from Grayscale.

Butterfill defined that the inflows could possibly be attributed to the “weaker-than-expected US macro information,” which has raised expectations for financial coverage fee cuts. He added:

“[The] optimistic value motion noticed whole property beneath administration (AuM) rise above the $100 billion mark for the primary time since March this yr.”

In the meantime, buying and selling exercise for these funding merchandise surged after weeks of subdued actions. Final week, buying and selling quantity was boosted by 55% to $12.8 billion, considerably exceeding the $8 billion recorded within the prior week.

Bitcoin, Ethereum drive flows

Bitcoin (BTC) stays a vital curiosity for buyers, registering $1.9 billion in inflows. In the meantime, brief BTC merchandise skilled outflows for the third consecutive week, totaling $5.3 million.

Ethereum (ETH) noticed a big resurgence, with $69 million in inflows, marking its finest week since March. This pushed ETH’s year-to-date flows to $81 million, recovering from earlier losses earlier than the SEC accredited a number of spot Ethereum ETF 19b-4 filings.

Different important altcoins had minor actions, with inflows beneath $1 million. Nevertheless, Fantom and XRP stood out, recording inflows of $1.4 million and $1.2 million, respectively.