Bitcoin has just lately taken a dip after reaching a two-month excessive, with market veteran Peter Brandt declaring an uncommon buying and selling sample.

Because the main cryptocurrency struggles to regain its footing following a pointy correction, Brandt just lately offered the investing public with a sample he calls the “Three Blind Mice and a Piece of Cheese.”

Bitcoin Faces Sharp Retracement

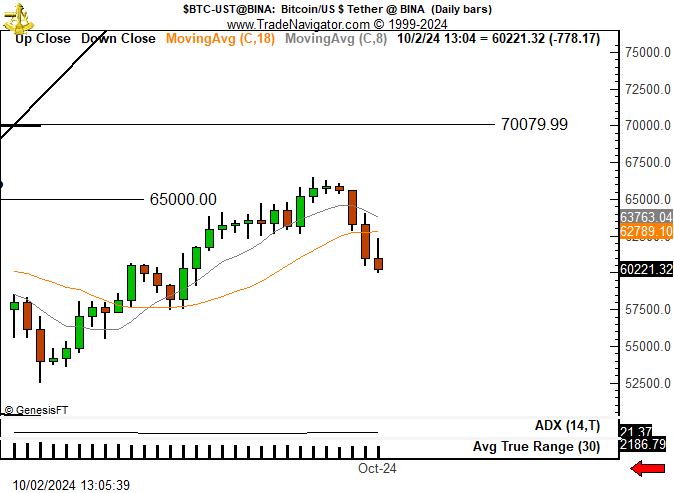

Towards the top of September, Bitcoin hit a excessive of $66,508, marking its finest efficiency in two months. Nevertheless, the joy was short-lived, because the firstborn crypto retraced by greater than 7.7% over the next days, dropping to round $60,221 yesterday.

Brandt’s 1-day chart reveals three consecutive bearish each day candles, with costs sliding under vital technical ranges. Amid the correction, analysts surprise if the worst is but to come back or if Bitcoin is getting ready for an additional breakout.

This downturn coincides with rising world uncertainty, particularly surrounding tensions within the Center East, which has led buyers to shrink back from riskier property like cryptocurrencies. The bearish resolve has neutralized the bullish momentum anticipated in “Uptober.”

Brandt’s “three blind mice” sample has additional bolstered considerations round Bitcoin’s worth motion. Though he has not totally defined this time period, some analysts counsel it might check with a continuation sample, the place the worth is prone to observe the established bearish pattern from the three bearish candles.

Analysts check with related setups, such because the “Three Black Crows” sample, as a bearish sign {that a} market is shedding steam and will face continued promoting strain. With Bitcoin now buying and selling under two key transferring averages, the short-term outlook seems dim.

Bitcoin’s Technicals Look Dim

Brandt’s chart reveals that Bitcoin’s present worth sits under the 8-day and 18-day transferring averages. This indicators weak point within the quick time period, implying that sellers have gained management. If Bitcoin doesn’t get better above these ranges quickly, additional losses might spring up.

In the meantime, the ADX is hovering round 21.37. This quantity means that the present pattern lacks power. The positioning signifies that the market is in a consolidation section, however the threat of additional downward motion stays excessive. Brandt beforehand advised BTC continues to be within the bearish section.

Regardless of the latest downturn, Bitcoin’s psychological and technical assist at $60,000 stays intact for now. If the worth breaks under this stage, it might result in one other wave of promoting. This new wave might push Bitcoin in direction of the $58,000 mark.

Nevertheless, the ATR reveals rising volatility, which suggests merchants ought to count on bigger worth swings within the coming days. Regardless of the issue in predicting Bitcoin’s subsequent path, indicators counsel {that a} deeper correction continues to be potential.

Whereas Bitcoin’s decline has dissatisfied bulls, the market might nonetheless expertise a reversal. Traditionally, October has been a robust month for crypto, and if Bitcoin can maintain above $60,000, there’s potential for a rebound towards $65,000.

Disclaimer: This content material is informational and shouldn’t be thought of monetary recommendation. The views expressed on this article could embody the writer’s private opinions and don’t mirror The Crypto Fundamental’s opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Fundamental will not be answerable for any monetary losses.