Merchants and traders within the crypto market ought to brace for volatility, with $5.26 billion price of Bitcoin and Ethereum choices expiring at the moment.

Particularly, Bitcoin (BTC) choices due for expiry complete $4.25 billion in notional worth, whereas Ethereum (ETH) choices account for $1.01 billion. With this, markets await the influence of such expansive contracts’ expiring.

What $5 Billion Bitcoin, Ethereum Choices Expiry Means

Based on knowledge on Deribit, an expansive 62,657 Bitcoin choices contracts will expire on October 25, with a put-to-call ratio of 0.66 and a most ache level of $64,000.

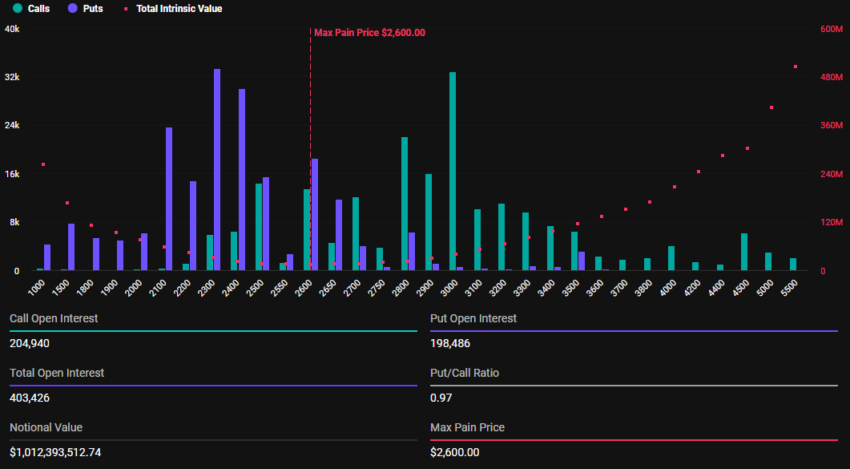

On the similar time, Ethereum’s choices market is ready to run out with 403,426 contracts. Right this moment’s expiring Ethereum contracts have a put-to-call ratio of 0.97, with a most ache level of $2,600.

Learn extra: An Introduction to Crypto Choices Buying and selling.

The put-to-call ratio is a crucial sentiment indicator in choices buying and selling. It compares the quantity of put choices traded to name choices. When this metric is beneath 1, it usually alerts bullish sentiment, with extra traders anticipating market beneficial properties. Then again, a ratio above 1 usually suggests bearish sentiment, signaling considerations a few market decline.

In the meantime, based mostly on BeInCrypto knowledge, Bitcoin is buying and selling at $67,962 as of this writing, whereas Ethereum is buying and selling at $2,490. Because of this whereas BTC is buying and selling above its most paint level, Ethereum is buying and selling beneath it.

Worth Implication Based mostly On Max Ache Level Principle

With Bitcoin value at the moment above its max ache level, if the choices expire on the present degree, it will usually signify losses for choices contract holders. The reverse applies to Ethereum, which is beneath its strike value as choices holders stand to profit. That is based mostly on the Max Ache idea, which predicts that choices costs will converge across the strike costs the place the biggest variety of contracts — calls and places alike — expire nugatory.

Due to this fact, it signifies that because the choices contracts close to expiration, Bitcoin and Ethereum costs are probably to attract towards their respective most ache factors. This implies BTC worth might drop whereas ETH value may rise in a calculated transfer by good cash. Nonetheless, the stress on BTC and ETH costs will cut back after 08:00 UTC on Friday, when Deribit settles the contracts.

Additionally it is price mentioning that the quantity of BTC and ETH choices expiring at the moment is considerably greater than what was seen earlier within the month. BeInCrypto reported $1.4 billion within the buying and selling week ending October 4, adopted by $1.6 billion within the week ending October 11.

Subsequently, the week ending October 18 noticed as much as $1.62 billion possibility contracts expire. The leap to over $5 billion choices expiring is subsequently vital, with a sustained rising pattern. In the meantime, analysts at BloFin Academy say there’s additionally a notable change in implied volatility (IV) forward of the US elections.

“The change in implied volatility first displays the election’s influence on the anticipated volatility of the crypto market. Whether or not it’s BTC or ETH choices, the implied volatility degree of choices expiring on November 8 has elevated considerably and exceeded that of far-month choices,” stated the analysts.

They ascribe the change in IV to traders’ hedging and speculative wants. The analysts additionally observe comparatively greater will increase in BTC’s “election day possibility.” This exhibits that BTC is comparatively extra delicate to macro occasions. For now, nevertheless, most traders stay on the sidelines, limiting the quantity of volatility that ought to be anticipated in October.

Learn extra: 9 Greatest Crypto Choices Buying and selling Platforms.

“Curiously, traders appear to consider that there won’t be a lot volatility in the remainder of October. As most traders are on the sidelines earlier than the election, the efficiency of the crypto market is especially consolidation, which additionally boosts traders’ confidence in pricing decrease volatility. After all, affected by provide, demand, and sentiment, choices expiring on Nov 8 have gotten dearer,” BioFin Academy analysts added.

One other influencing issue, based on the analysts, is coverage uncertainties within the US by the Federal Reserve.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.