champc

With inflation pressures hitting all the key indices, actual property shares suffered a slight loss this week.

With inflation staying sticky, merchants are lowering bets on a charge lower in Might.

“There is a significant probability — perhaps it is 15% — that the [Federal Reserve’s] subsequent transfer goes to be upwards in charges, not downwards,” former Treasury Secretary Lawrence Summers mentioned in an interview on Friday, citing a variety of “disturbing” inflation pressures.

The Dow Jones Industrial Common Index closed at 38,627.99 on Friday, 0.11% down from per week in the past, whereas NASDAQ Composite Index was down 1.34% to fifteen,775.65.

S&P 500 fell by 0.42% W/W to shut at 5,005.57, when the index had gained ~5% from the start of 2024.

XLRE, which tracks S&P 500 actual property shares, declined by 0.15% from final week to shut at 38.35. The index is down 4.27% YTD.

The ETF noticed web inflows of $147.22M this week, as in comparison with outflows of $13.06M within the earlier week, information from the info options supplier VettaFi confirmed.

Brixmor Property Group (BRX), Safehold (SAFE), Zillow Group (Z)(ZG), STAG Industrial (STAG), Blackstone Mortgage Belief (BXMT), Chimera Funding (CIM) and Opendoor Applied sciences (OPEN) have been the notable earnings winners of the week.

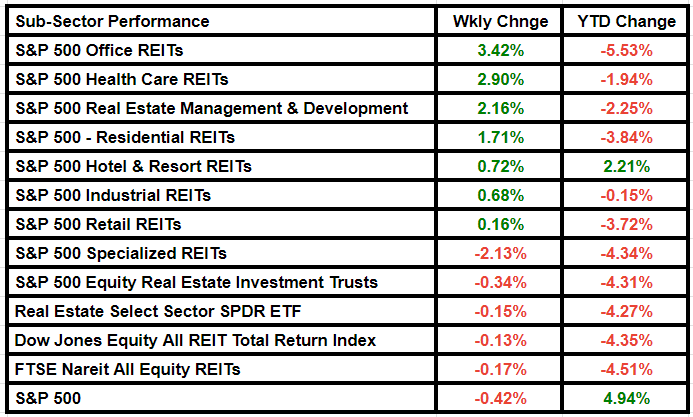

Amongst subsectors, Workplace and Well being Care gained essentially the most. Here’s a take a look at the subsector efficiency:

Extra on Actual Property: