This week has confirmed troublesome for Bitcoin and the broader crypto market. After almost reaching the $60,000 mark, Bitcoin’s worth has dropped about 5%, presently buying and selling at roughly $56,400.

Important outflows from spot Bitcoin Alternate Traded Funds (ETFs) notably influenced the downturn.

Crypto Market Enters Excessive Worry as Bitcoin Struggles

Though US markets had been closed on Monday, substantial withdrawals resumed thereafter. On Tuesday, spot Bitcoin ETFs noticed a web outflow of $287.78 million.

Subsequently, on Wednesday, ETFs recorded an additional withdrawal of $37.29 million, adopted by $211.15 million on Thursday. Due to this fact, spot Bitcoin ETFs recorded a complete outflow of $536.22 million this week.

Learn extra: How To Commerce a Bitcoin ETF: A Step-by-Step Strategy

In gentle of those outflows, a number of trade leaders have voiced a bearish perspective on Bitcoin. Arthur Hayes, co-founder of the BitMEX crypto alternate, brazenly introduced his quick place on Bitcoin, concentrating on a fall under $50,000.

“BTC is heavy, I’m gunning for sub $50,000 this weekend. I took a cheeky quick. Pray for my soul, for I’m a degen,” Hayes shared on X (previously Twitter).

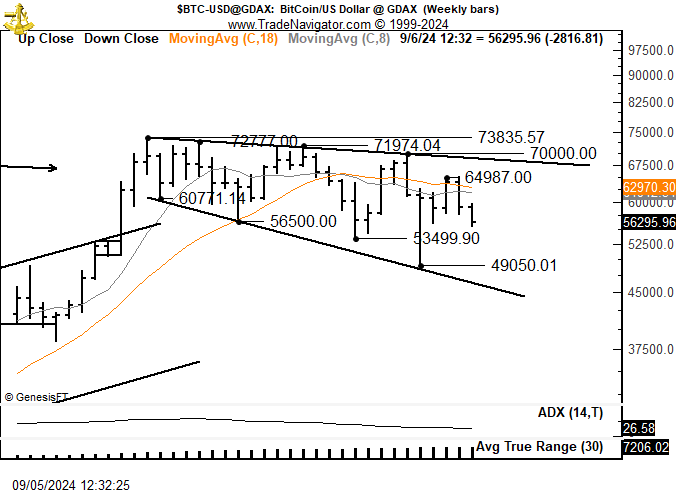

Equally, veteran dealer Peter Brandt recommended that Bitcoin may decline to the $46,000 degree.

“That is referred to as an inverted increasing triangle or a megaphone. A take a look at of the decrease boundary could be to $46,000 or so. A large thrust into new all time highs is required to get this bull market again on monitor for Bitcoin. Promoting is stronger than shopping for on this sample,” Brandt detailed.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

Furthermore, the US jobs non-farm payroll report is due at present. This information is essential as it’d affect the Federal Reserve’s fee determination. A very weak jobs report final month already triggered international market instability, impacting cryptocurrencies as nicely.

“The upcoming launch of the US payroll information is eagerly anticipated by traders, because it may affect the Federal Reserve’s determination on the potential dimension of the rate of interest reduce this month. The market’s volatility displays the uncertainty surrounding this significant financial indicator,” Avinash Shekhar, CEO of crypto derivatives alternate Pi42, informed BeInCrypto.

Consequently, the cryptocurrency market has plummeted into an “excessive concern” zone, as per the Crypto Worry & Greed Index, which measures market sentiment. On September 6, the index fell to 22, indicating “excessive concern”—a stark distinction from the day past’s rating of 29, labeled “concern.” This marks the bottom rating since August 8, when the index hit 20.

Learn extra: What Is the Crypto Worry and Greed Index?

Regardless of the pervasive destructive sentiment, some merchants spot potential alternatives. Quinten Francois, a well known crypto investor, highlighted that market sentiments mirror these when Bitcoin final hit a low of $16,000 in November 2022. Therefore, he suggested the traders to behave accordingly.

Nonetheless, it’s essential to acknowledge that excessive concern can persist, doubtlessly resulting in prolonged intervals of market uncertainty.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.