Markets anticipate a 50 foundation level (bp) fee minimize in September amid deteriorating US Job information. In keeping with the US Non-farm Payrolls (NFP) information launched on Friday, the US economic system added 142,000 jobs in August, beneath the anticipated 164,000.

On account of this anticipation, Bitcoin shot up over 2% inside half-hour.

Bitcoin Approaches $57,000

On the time of writing, Bitcoin (BTC) is buying and selling for $56,821, swiftly transferring in direction of the $57,000 mark.

The August unemployment fee hit expectations, coming in at 4.2%. It means unemployment is again on the decline, after the 4.3% recorded in July.

“Large decline in “momentary layoffs” in August. That’s a key motive the unemployment fee went again to 4.2%. It appears to be like like July’s huge unemployment fee spike was largely a fluke. But it surely’s simple the labor market is cooling off rather a lot (and will simply worsen),” Heather Lengthy, Financial Columnist on the Washington Publish, stated.

Learn extra: 11 Cryptos To Add To Your Portfolio Earlier than Altcoin Season

Whereas these information present that the US job market has cooled off, in addition they point out that there are clear warning indicators. However, a “comfortable touchdown” stays attainable. Within the rapid aftermath of the report, risk-on belongings like Bitcoin jumped briefly, testing $57,000 in response to the buck’s weakening over weak US job information.

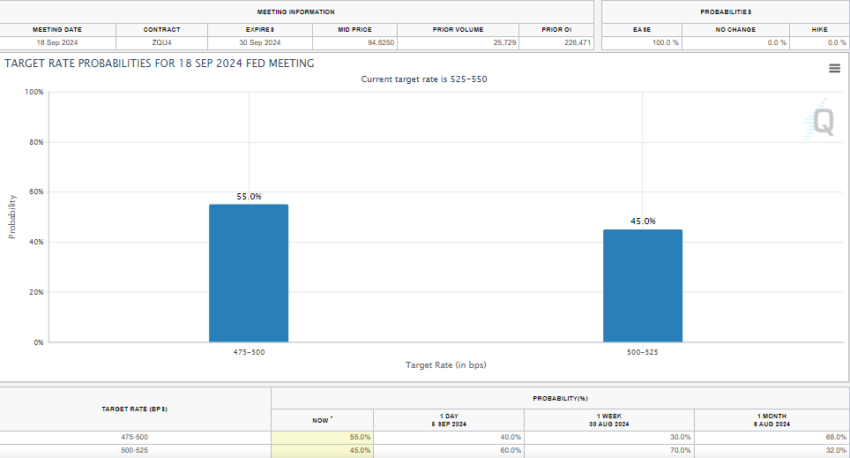

Based mostly on the Fed’s CME Watchtool, markets are pricing in a 50bp minimize in September, as possibilities leap from 30.5% to 55%. In the meantime, the chance of a 25bp fee minimize has since shrunk to 45%.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.