Over the weekend, Bitcoin (BTC) ‘s worth circled between $54,424 and $58,215. Nevertheless, as the brand new week begins, the coin presents an fascinating revelation on-chain that would affect its subsequent path.

To place it in perspective, this situation has been traditionally essential to BTC’s restoration. Will or not it’s the identical this time?

Bitcoin Oversold, Drives A number of Bids

The metric in query is the NVT Golden Cross. NVT stands for Community Worth to Transaction. Outlined as a reformed index of the NVT ratio, the metric gauges if Bitcoin has hit the underside or is on the prime.

When the worth of this metric is 2.20 or above, it means the coin has hit the highest, and a decline is imminent. As seen within the picture beneath, this occurred in December 2023, March 2024, and most lately, Could.

Comparatively, if the NVT Golden Cross is below -1.60, it implies that BTC is close to or has hit the underside.

At the moment, the metric is at -1.39, a possible signal of overselling. This promoting strain may be linked to Mt. Gox’s current motion of BTC.

Other than that, the quite a few transfers by the German authorities performed an element. Nevertheless, because it stands, the coin could also be on the trail of restoration, as overselling may foreshadow a rebound.

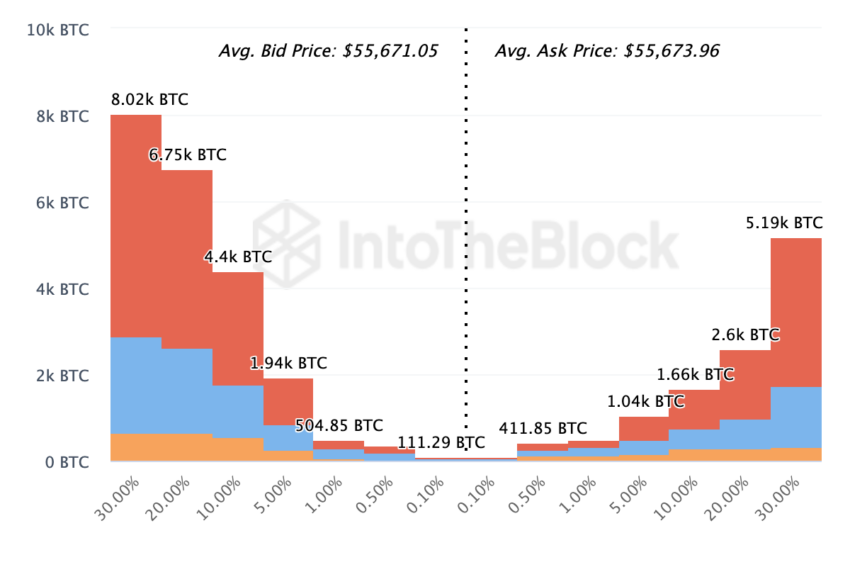

Moreover, market contributors appear to be ready in line to purchase BTC on the present low cost costs. BeInCrypto found this after analyzing the Change On-chain Market Depth.

Learn Extra: Methods to Purchase Bitcoin (BTC) on eToro: A Step-by-Step Information

This metric considers the actions on the order books of the highest 20 exchanges. Divided into two elements, Change On-chain Market Depth considers the bid (purchase) and ask (promote) segments.

In line with IntoTheBlock, contributors have positioned bids for 22,075 BTC at a mean worth of 55,671. Nevertheless, the whole worth of BTC set to be offloaded is 11,514 BTC at a mean worth of $55,673

Contemplating the upper worth to be purchased, Bitcoin’s worth might evade one other downturn and get better a few of its current losses.

BTC Worth Prediction: No Extra Collapse

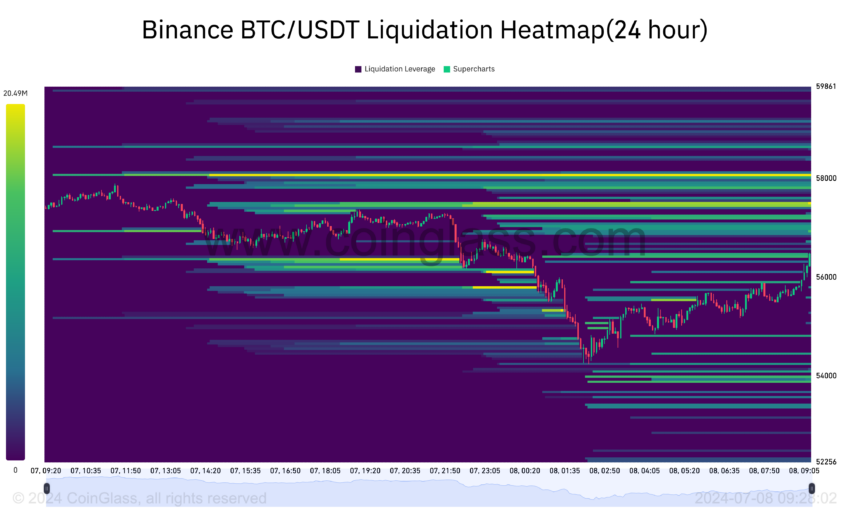

At press time, Bitcoin is buying and selling at $56,752. Nevertheless, the Liquidation Heatmap means that the value could possibly be increased within the quick time period.

Liquidations Heatmap makes use of shade variations to gauge the depth of purchase and promote orders available in the market. Cooler colours like purple point out a low stage of exercise. However when colours like inexperienced or yellow seem, it means the liquidity is concentrated at a worth stage.

By analyzing the heatmap, one can spot potential areas of curiosity, resistance, and assist ranges.

In line with Coinglass, there’s a excessive stage of liquidity at $57,516 and one other at $58,037. This excessive stage of liquidity may appeal to a Bitcoin worth improve in these areas.

Learn Extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

The Relative Power Index (RSI), which measures momentum, additionally helps this potential. On the each day BTC/USD chart, it’s at 34.61.

When the indicator’s studying is beneath 30.00, it’s oversold. When it’s above 70.00, it’s overbought. Subsequently, the RSI’s place implies that Bitcoin has left the oversold area and goals for substantial restoration.

Going by the positions of the Fibonacci Retracements, which spot helps and resistance factors, BTC might retest $58.251 if it breaks by means of $57,016.

In the meantime, RektCapital, a pseudonymous analyst on X, additionally commented on Bitcoin’s worth motion. In line with him, the coin might have left sideways buying and selling whereas closing in on re-accumulation.

“Bitcoin is on the cusp of performing its first Weekly Candle Shut beneath the Re-Accumulation Vary Low for the primary time within the over 4 months that this vary has existed,” Rekt Capital posted.

Nevertheless, the coin nonetheless trades beneath the 20-day Exponential Shifting Common (EMA), which tracks worth modifications to find out a pattern’s strengths or weaknesses.

If Bitcoin’s worth is above the 20-day EMA, it could point out a stable bullish pattern. Nevertheless, so long as the coin wobbles beneath the brink, it dangers retracement to $55,019.

Disclaimer

In step with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.