Bitcoin (BTC) is poised for a possible surge after forming a bullish technical sample and attracting a wave of institutional funding. The world’s main cryptocurrency lately surpassed the $70,000 mark, setting the stage for a doable breakout that might eclipse its present all-time excessive of $73,750.

This optimistic outlook comes from analyst Ali Martinez, who recognized a bull flag sample on Bitcoin’s 4-hour chart. This technical indicator usually follows a big worth improve and signifies a consolidation interval with a slight downward pattern. Nevertheless, the lowering buying and selling quantity throughout this part suggests a brief pause moderately than a reversal, probably resulting in a renewed uptrend.

Validating The Bull Flag Sample: Bitcoin Consolidation Part Evaluation

Bitcoin’s current dip beneath $61,000 served as a testing floor for this concept. The cryptocurrency demonstrated resilience by rebounding into the $67,000-$70,000 vary, solidifying the potential validity of the bull flag sample. This consolidation part is essential for market contributors to reassess their positions and gauge total investor sentiment.

#Bitcoin seems to be breaking out of a bull flag on the 4-hour chart! If $BTC holds above $70,000, we might see a surge of almost 10% to a brand new all-time excessive of $77,000! pic.twitter.com/MPVB70p9DU

— Ali (@ali_charts) March 28, 2024

The current dip wasn’t essentially a trigger for alarm, defined Martinez. Actually, it may very well be interpreted as a wholesome consolidation that strengthens the muse for additional progress.

Past technical evaluation, a big shift in Bitcoin’s possession construction is fueling optimism. The long-awaited launch of spot Bitcoin Trade Traded Funds (ETFs) in the USA has opened the door for institutional traders. These professionally managed funds, backed by main monetary establishments, are estimated to carry a mixed 5% of the entire Bitcoin provide.

Whole crypto market cap is presently at $2.545 trillion. Chart: TradingView

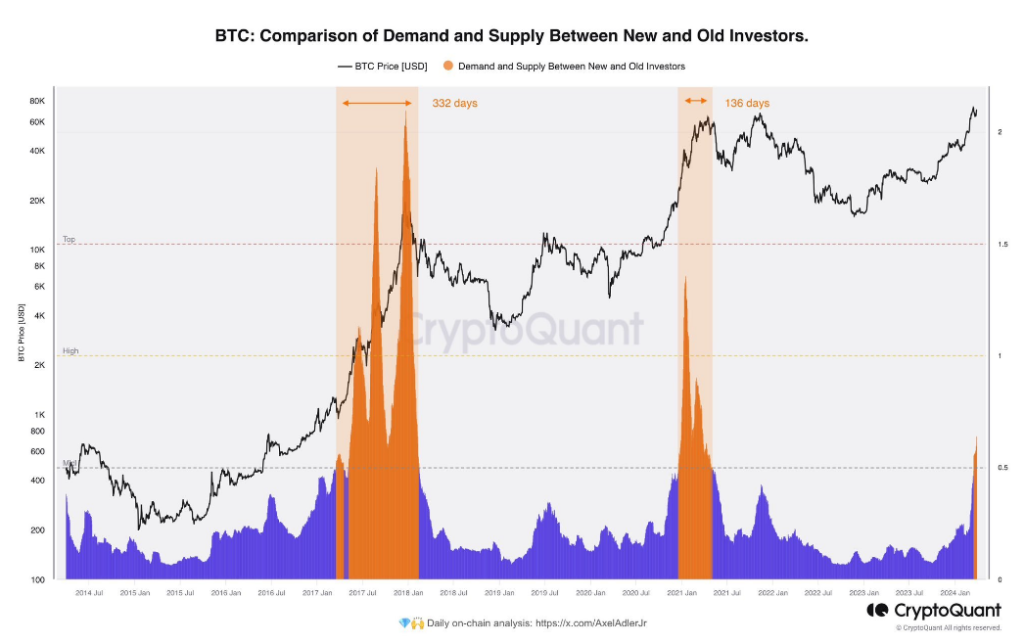

On-chain information additional corroborates this institutional inflow. CryptoQuant, a blockchain analytics agency, stories a deviation from previous bull cycles. Historically, Bitcoin possession flowed from present massive holders (“whales”) to retail traders. Nevertheless, the present market cycle seems to be witnessing a switch from these whales to new whales – conventional monetary establishments.

Bitcoin’s Bullish Value Predictions

The inflow of institutional capital has emboldened some analysts to make bullish worth predictions. Whereas Martinez shunned providing a selected timeframe for the anticipated breakout above $73,750, others are extra forthcoming. Optimistic forecasts vary from $100,000 to $150,000 for Bitcoin by the top of 2024, with some even predicting a staggering worth of $500,000 by 2025.

Associated Studying: Fantom: Market Slowdown Chops Off 10% From Positive aspects – Right here’s Why

Nevertheless, specialists warning towards blindly following such excessive predictions. The cryptocurrency market stays inherently unstable, and technical evaluation isn’t a foolproof technique for guaranteeing future worth actions. The long-term influence of institutional involvement on market dynamics can be but to be absolutely understood.

Regardless of these phrases of warning, the confluence of a bullish technical sample and a surge in institutional funding has undeniably created a way of pleasure surrounding Bitcoin. Because the world’s main cryptocurrency continues its ascent in direction of uncharted territory, all eyes are on whether or not it will probably certainly break new floor and set up a brand new all-time excessive.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site solely at your individual danger.