Fast Take

The primary half of 2024 has witnessed important developments within the digital property market, notably for Bitcoin and Ethereum, as highlighted in a complete report compiled by Glassnode and CME. The report delves into the insights and evolution of the market following the launch of the US Bitcoin ETFs on Jan. 11 and the impact on derivatives markets.

Within the crypto business, two main futures devices are utilized: the perpetual swap and the normal calendar-expiring contract. In accordance with the report, perpetual open curiosity is presently at roughly $16.6 billion, whereas calendar open curiosity stands at $12.6 billion. Traditionally, perpetual open curiosity dominated till 2023. Nonetheless, 2024 has seen a notable enhance in calendar expiring futures, attributed to a surge in curiosity from institutional traders, with a big quantity traded through CME Group Devices.

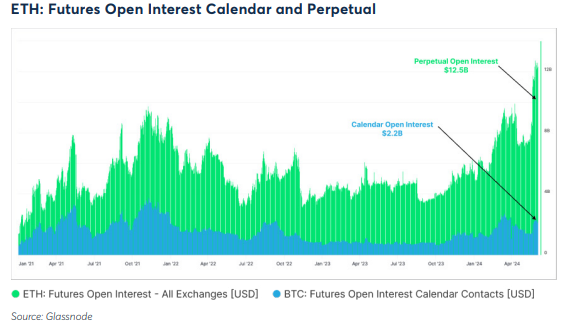

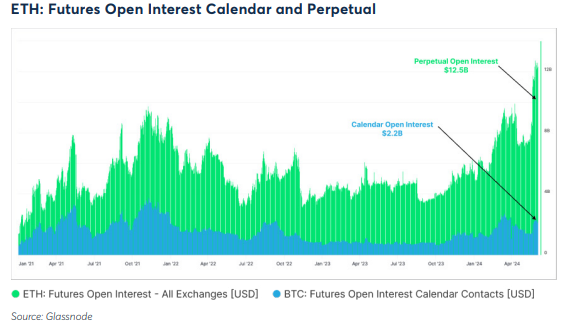

The report exhibits that this shift is just not mirrored in Ethereum, the place perpetual open curiosity stays the dominant alternative, with $12.5 billion in comparison with $2.2 billion in calendar open curiosity. The upcoming ETF launch in July raises questions on whether or not this dynamic may shift in Ethereum’s market.

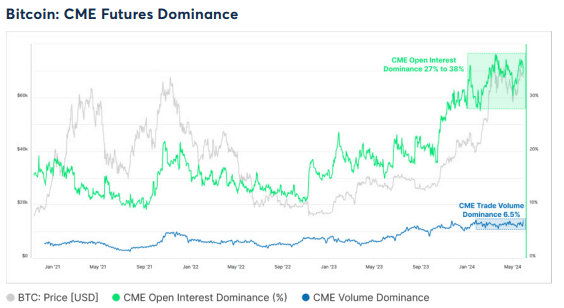

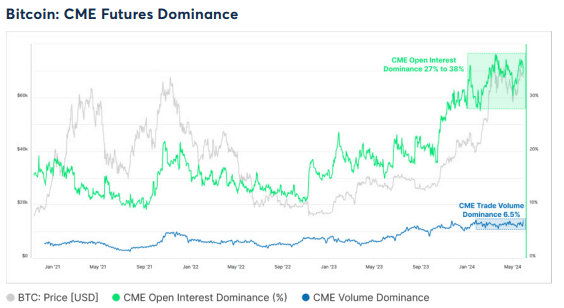

Supporting this development, Bitcoin CME Futures have proven exceptional dominance, representing over one-third of all open futures contracts positions in Bitcoin. Moreover, in keeping with the report, CME’s commerce quantity continues to achieve market share, presently at 6.5%, which is at a multi-year excessive.

This report illustrates the rising affect of institutional traders in shaping the futures market, primarily by way of CME Group’s choices, and indicators potential shifts in market forces with forthcoming developments such because the Ethereum ETF launch.