US Bitcoin exchange-traded funds (ETFs) have recorded web outflows for eight days in a row, leading to a loss exceeding $1 billion from August 27 to September 6.

This outflow development has additionally contributed to bringing the entire web belongings of Bitcoin ETFs to below $50 billion.

Why Bitcoin ETFs Are Experiencing Heavy Outflows

Knowledge from SoSoValue reveals that Bitcoin ETFs have skilled regular outflows totaling roughly $1.1 billion since August 27. In the course of the interval, Constancy led the redemptions, with traders promoting over $450 million price of shares in its FBTC fund.

Ark 21Shares’ ARKB fund adopted with over $220 million in outflows. Bitwise’s BITB noticed $109 million in outflows, whereas BlackRock’s IBIT skilled modest outflows of below $15 million.

Grayscale’s GBTC, which transitioned into an ETF in January, continues to face vital redemptions, with $280 million in outflows in the course of the interval. Since its conversion, GBTC has seen a web lack of over $20 billion.

Learn extra: How To Commerce a Bitcoin ETF: A Step-by-Step Method

The cumulative web influx for the ETFs has additionally declined. From a peak of $18.08 billion on August 26, it had fallen to $16.89 billion at press time.

This downturn displays a cooling enthusiasm for Bitcoin ETFs, which launched with record-breaking success. Most of this decline is tied to Bitcoin’s current value struggles.

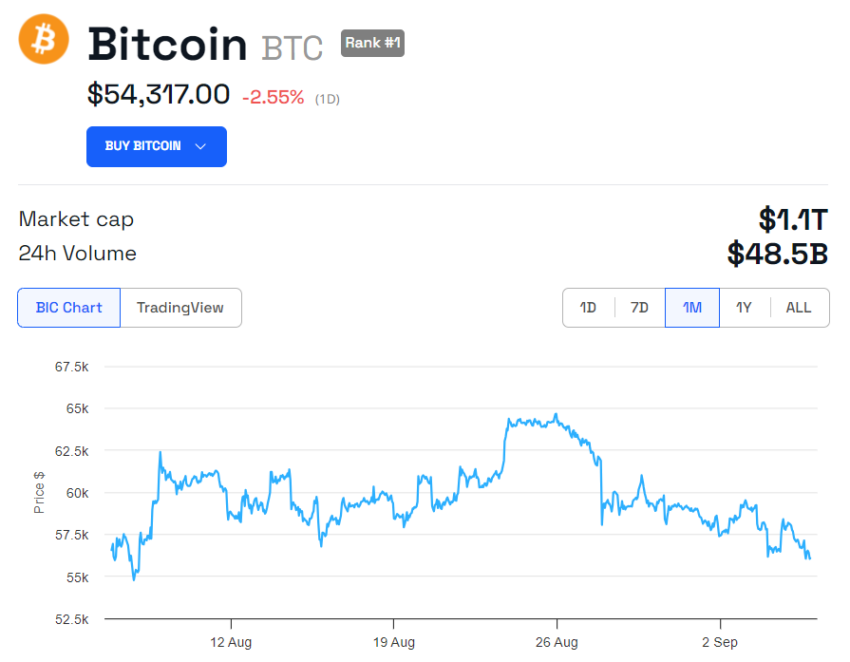

After reaching a excessive of over $73,000 in March, Bitcoin has slipped to as little as $52,598 in the course of the previous day, persevering with a week-long downward development that noticed its worth decline by round 10%.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

Regardless of the outflow narrative, crypto analyst Hitesh argues that the market has largely ignored inflows to those monetary devices. He famous that whereas Bitcoin ETF netflows have been adverse for the previous two weeks, the ETF merchandise have seen a cumulative optimistic netflow of $3.5 billion within the final three months.

In line with Hitesh, this means that traders have bought $3.5 billion price of Bitcoin within the $57,000–$68,000 value vary.

“Most of those investments have been made at costs above $60,000, and I imagine the netflow may return to optimistic as quickly as Bitcoin value will get again to that degree once more,” he added.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.