For the reason that US Securities and Change Fee (SEC) authorised spot Bitcoin exchange-traded funds (ETFs) on January 11, 2024, the crypto market has skilled a major restoration. This culminated on March 14, 2024, when Bitcoin (BTC) reached a brand new all-time excessive (ATH) of $73,737.

This uptrend isn’t confined to the US alone. Hong Kong simply launched its spot Bitcoin and Ethereum ETFs, whereas Australia is getting ready to launch its personal variations of spot Bitcoin ETFs.

The worldwide enthusiasm mirrors the neighborhood’s optimistic view of Bitcoin as not only a forex however a possible digital counterpart to gold.

Can Bitcoin ETFs Assist Maintain 8-Yr Bull Rally?

The narrative of Bitcoin as a retailer of worth and an inflation hedge brings it near gold’s market stance, with comparisons now extending to their respective ETFs. Historic precedents supply a compelling storyline.

The gold ETF launch in 2004 triggered an almost 8-year bull market. The primary gold ETF, SDPR Gold Shares, was listed on the New York Inventory Change (NYSE) on November 1, 2004, when gold was priced at $450.80 per ounce. It then constantly grew, reaching $1,825 on August 1, 2011. In 2024, gold has efficiently achieved a value of $2,392 on April 19.

Nevertheless, based on a submit by crypto YouTuber Altcoin Every day on X (previously Twitter), the BlackRock Bitcoin ETF achieved in 70 days what took the gold ETF over 800 days in belongings beneath administration (AUM). He highlighted the unprecedented demand for Bitcoin in comparison with gold’s preliminary days within the ETF sphere.

“That is only the start…” Altcoin Every day famous.

Learn extra: Crypto ETN vs. Crypto ETF: What Is the Distinction?

Supporting this attitude, Bitcoin analyst Willy Woo identified the present fiscal dynamics.

“Now that the financial inflation price of Bitcoin has dropped under Gold, will probably be fascinating to see if its market cap will exceed gold based on the inventory to circulation [S2F] thesis,” Woo commented.

He anticipates that Bitcoin will align with its S2F valuation however with a lag of 5-10 years. Woo cites the slower tempo of worldwide monetary techniques in adopting such improvements.

Bitcoin’s technological structure may give it one other edge over gold. Occasions just like the quadrennial halving are designed to scale back the variety of new Bitcoins coming into the market, theoretically rising its worth over time.

Certainly, traditionally talking, post-halving durations have led to substantial value will increase. The 2012 halving preceded a leap from $12 to over $1,000 by late 2013. Equally, the 2016 halving noticed costs soar from round $650 to almost $20,000 by December 2017. Lastly, the 2020 halving pushed costs from round $8,000 to $69,000 by November 2021.

These patterns counsel a bullish outlook, albeit with the caveat that value surges are usually long-term fairly than instant. Famend analyst PlanB reaffirmed this. They predicted vital future progress regardless of short-term fluctuations.

PlanB famous a bullish outlook that aligns with historic knowledge and market evaluation regardless of present market variances.

“BTC > $100,000 in 2024. BTC high > $300,000 in 2025,” PlanB said.

Worth Retreats Regardless of ETF Success

But, no matter speculative optimism and historic developments, at the moment’s market motion paints a unique image. On the time of writing, Bitcoin trades at $62,035, a slight lower of 0.47% over the past 24 hours.

Equally, spot gold can be experiencing modest motion, buying and selling at $2,311. This quantity represents a lower of roughly 1.02% from yesterday’s value.

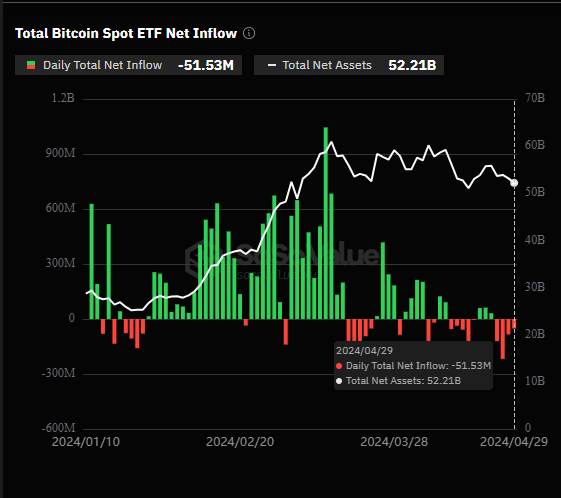

Moreover, knowledge from SoSo Worth signifies that US spot Bitcoin ETFs have recorded day by day outflows of $51.53 million as of April 29, 2024. This marks the fourth consecutive day of detrimental flows. Even BlackRock’s iShares Bitcoin Belief (IBIT), beforehand a high performer, recorded no new inflows throughout the interval.

Learn extra: Bitcoin Worth Prediction 2024/2025/2030

These indicators counsel a cautious method. Whereas the keenness round Bitcoin ETFs is palpable, and comparisons to gold’s ETF-driven rally are tempting, the truth on the buying and selling flooring tells a narrative of volatility and speculative uncertainty.

With its complicated interaction of know-how, economics, and international laws, Bitcoin presents a novel funding perspective that will or could not parallel the historic ascent of gold. Buyers and spectators alike would do nicely to watch these developments carefully, contemplating each the potential and the pitfalls of this digital asset class.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.