The cryptocurrency market is getting ready for short-term volatility, with roughly $1.4 billion value of Bitcoin and Ethereum choices expiring at present.

With Bitcoin choices totaling $1.066 billion in notional worth and Ethereum choices accounting for $284.99 million, merchants are eyeing the expiration for its potential affect on costs.

Analysts Predict A Market Shakeout Amid Expiring Choices

Information on Deribit exhibits 17,448 Bitcoin choices contracts will expire on October 4. The contracts have a put-to-call ratio of 0.75 and a most ache level of $63,000.

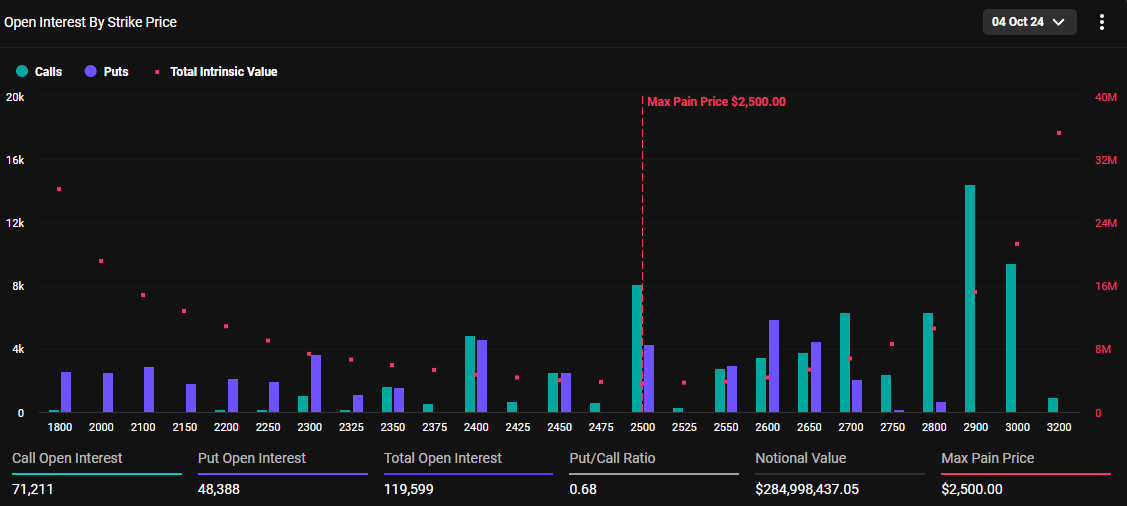

On the similar time, Ethereum’s choices market is ready to run out with 119,599 contracts. As we speak’s expiring Ethereum contracts have a put-to-call ratio of 0.68, with a most ache level of $2,500.

Learn extra: An Introduction to Crypto Choices Buying and selling

n choices buying and selling, the put-to-call ratio serves as a key sentiment indicator by evaluating the amount of put choices traded to name choices. A put-to-call ratio of 0.75 for Bitcoin means that extra name choices are being traded, indicating bullish market sentiment. Equally, Ethereum’s put-to-call ratio of 0.68 additionally factors to optimism, as extra calls than places are being exchanged.

For these unfamiliar with the idea, a put-to-call ratio under 1 usually alerts bullish sentiment, as extra traders count on market positive aspects. In distinction, a ratio above 1 usually displays bearish sentiment, signaling considerations a couple of market decline.

Worth Implication Primarily based on BTC and ETH Most Ache Factors

The present market costs for Bitcoin and Ethereum are under their respective most ache factors. BTC is buying and selling at $61,209 and ETH at $2,381. This means that if the choices have been to run out at these ranges, it will usually signify positive aspects for choices holders.

The result for choices merchants can fluctuate considerably relying on the particular strike costs and positions they maintain. To precisely assess potential positive aspects or losses at expiration, merchants should take into account their complete choices place, together with present market circumstances.

Analysts at Greeks.dwell counsel that extra market components might emerge, influencing general developments and affecting dealer choices. Subsequently, complete analysis is crucial earlier than drawing conclusions on choices trades.

“Friday’s unemployment charge and non-farm payrolls knowledge, and now the windy A-share market in comparison with the US inventory market is far much less favorable. Nonetheless, the cryptocurrency market is extra related to US shares, and the one connection between A-shares and crypto may be that many individuals are out of gold speculating in shares, pulling down the value of u fiat foreign money,” they wrote.

The analysts additionally say crypto markets are getting into a shakeout earlier than what has traditionally been a bullish month. A shakeout is when the in any other case “weak palms” are triggered to promote primarily based on scary market circumstances. Geopolitical tensions might irritate the sell-off, which continues to escalate.

“As we speak goes to be a giant day. Essential job knowledge is coming within the subsequent 7 hours, which is able to affect the US inventory market closely. We will get an excellent pump or heavy dump. Israel planning to launch a counterattack on Iran at present. Bitcoin wants to carry $60,000 for a bounce but when $60,000 breaks we are able to see a fast dump to $56,000-$57,000. One of the best technique is to carry your positions and never be shaken out,” analyst Ash Crypto suggested.

In the meantime, crypto markets stay subtly optimistic amid bullish US financial knowledge. The Federal Reserve’s determination to chop rates of interest amid cooling inflation conjures up optimism for riskier belongings. Economists count on extra charge cuts in 2024, however this stays to be seen. That is because the Fed continues to train its twin mandate- to realize most employment and maintain costs secure.

Learn extra: 9 Greatest Crypto Choices Buying and selling Platforms.

Merchants are due to this fact suggested to stay cautious, as traditionally, choices expiration usually results in short-term instability out there. The weekend may even be essential as it’s usually characterised by excessive volatility.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.