The price of producing a Bitcoin is taking a toll on Bitcoin miners whose machines are struggling to yield earnings because of the flagship digital asset’s value difficulties.

In response to information platform MacroMicro, the common value of mining a single BTC in the beginning of June soared to $83,668 however barely declined to round $72,000 as of July 2.

Bitcoin Mining Machines Turning into Unprofitable

James Butterfill, CoinShares’ head of digital analysis, shared information exhibiting that Bitcoin value was hovering across the common manufacturing value in the course of the April halving occasion. Per the info, half of the 14 recognized miners, together with Bit Digital and Riot Platforms, spend above the common value to provide their BTC, whereas Tether-backed Bitdeer and Hut8 spend beneath common.

Learn extra: Making Passive Earnings From Crypto Mining: How one can Get Began

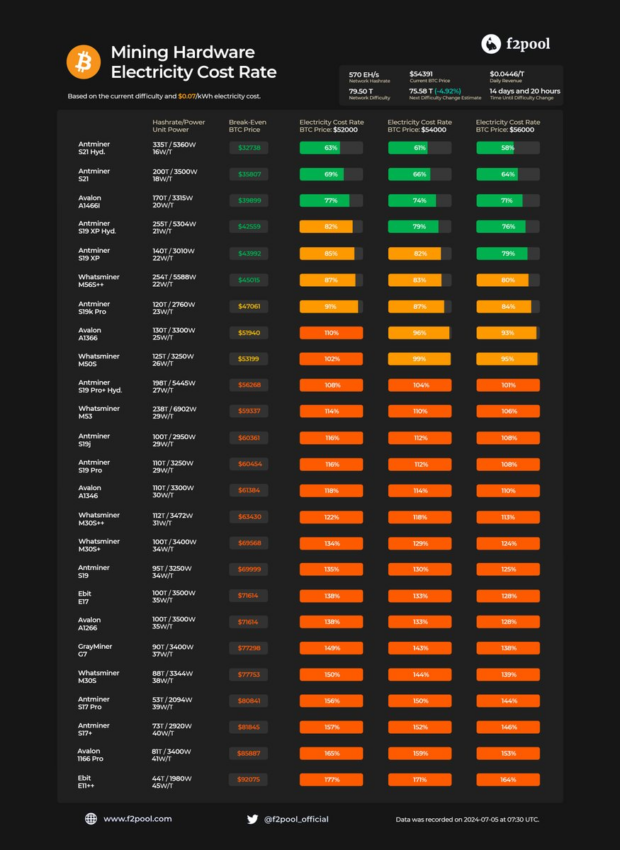

This case was additional confirmed by F2Pool, a Bitcoin mining pool operator. It said that solely ASIC machines with greater than 23 W/T effectivity had been worthwhile as of July 4.

In response to F2Pool information, solely six Bitcoin mining machines, together with Antminer S21 Hydro, Antminer S21, and Avalon A1466I, are worthwhile at break-even Bitcoin costs of $39,581, $43,292, and $48,240, respectively. Equally, different machines just like the Antminer S19 XP Hydro, Antminer S19 XP, and Whatsminer M56S++ are worthwhile, with Bitcoin costs exceeding $51,456, $53,187, and $54,424, respectively.

Nevertheless, Bitcoin mining issue dropped considerably on July 5, marking probably the most notable declines for the reason that FTX collapse. F2Pool defined that this might make extra machines worthwhile. They said that at a BTC value of $54,000, ASICs with unit energy of 26 W/T or much less would turn into worthwhile. They added that they estimate power prices at $0.07 per kWh.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

Final week, BeInCrypto reported that Bitcoin miners had been nearing capitulation ranges final seen in the course of the FTX change collapse. Consequently, Miners switched off unprofitable machines and intensified promoting actions, offloading roughly 30,000 BTC, valued at $2 billion, final month.

“All of the miners working nicely beneath their revenue factors are lastly decommissioning their inefficient machines or exiting the trade solely. […] Presumably many held on for for much longer than anticipated as a result of they anticipated a major value rise in bitcoin that greater than compensated,” defined Con Kolivas, the admin of Solo CKPool.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.