On-chain knowledge exhibits the Bitcoin Market Worth to Realized Worth (MVRV) Ratio of the short-term holders is at the moment making a retest that might show important for BTC’s value.

Bitcoin STH MVRV Ratio Is Retesting Its 155-Day MA Proper Now

As defined by on-chain analyst Checkmate in a brand new submit on X, the short-term holder MVRV Ratio breaking above its 155-day transferring common (MA) may result in bullish motion for Bitcoin.

The MVRV Ratio is a well-liked indicator that, briefly, retains observe of how the worth held by the BTC buyers as an entire (that’s, the market cap) compares in opposition to the worth that they initially put in (the realized cap). When the worth of this metric is bigger than 1, it means the typical deal with on the community might be assumed to be holding a internet revenue proper now. Alternatively, it being underneath the edge suggests the dominance of loss available in the market.

Within the context of the present subject, the MVRV Ratio of solely a particular section of the sector is of curiosity: the short-term holders (STHs). The STHs embrace the buyers who purchased their cash throughout the previous 155 days. Thus, the MVRV Ratio for this cohort tells us in regards to the revenue/loss standing of the consumers from the final 5 months.

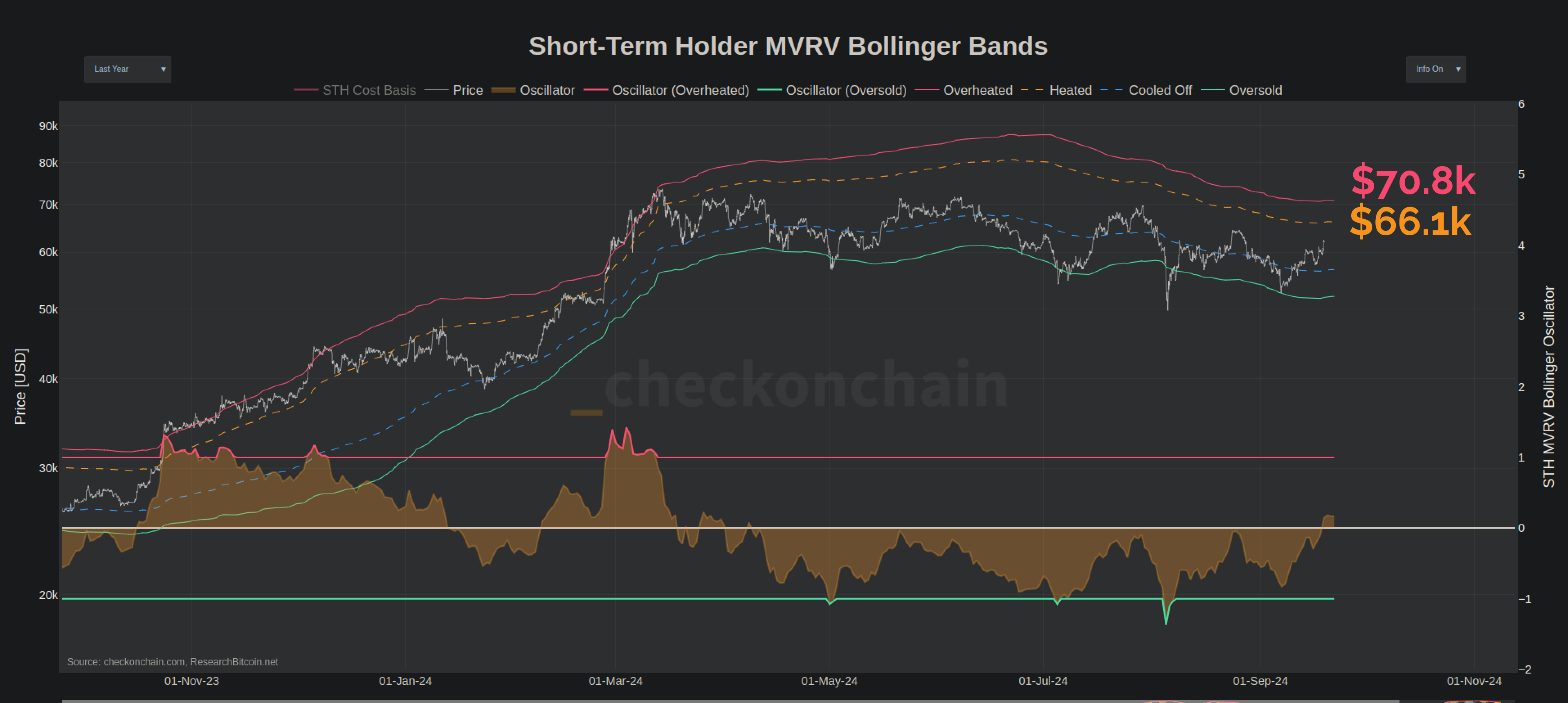

Now, here’s a chart that exhibits the pattern within the Bitcoin STH MVRV Ratio over the previous couple of years:

As displayed within the above graph, the Bitcoin STH MVRV Ratio has surged lately as the newest restoration rally within the cryptocurrency’s value has taken place. With this enhance, the indicator has edged simply above the 1 mark, implying profitability has returned for the cohort. Extra importantly, although, the metric is now looking for a break above its 155-day MA. As Checkmate has highlighted within the chart, BTC has usually tended to take pleasure in some bullish momentum at any time when the STH MVRV Ratio has crossed above this line.

The final time that such a crossover had occurred within the indicator was again within the first quarter of this 12 months and what had adopted it was the coin’s rally to a brand new all-time excessive (ATH).

Given the priority, it’s attainable that BTC could as soon as once more see a bullish wave, ought to the STH MVRV Ratio handle to interrupt past its 155-day MA. “If the bulls get their means, and we set a weekly larger excessive ~$65.3k, I’d fairly count on an try and the ATH,” notes the analyst.

Checkmate additionally warns, nonetheless, that profit-taking from these buyers might be to be careful for as soon as the worth reaches the $66,100 to $70,800 vary. It is because, these buyers, who don’t are inclined to have a powerful resolve, would get into notable income at these ranges.

BTC Value

Bitcoin has seen a bounce of round 8% over the previous week, which has taken its value to the $63,700 degree.