Crypto funding merchandise noticed inflows of as much as $321 million final week, a surge linked to rate of interest cuts by the Federal Open Market Committee (FOMC).

Bitcoin (BTC) stays the dominant asset, drawing a lot of the funding consideration, whereas altcoins proceed to take their lead from the pioneer cryptocurrency.

Bitcoin Leads $321 Million Crypto Funding Inflows

Digital asset funding merchandise noticed one other spherical of optimistic inflows, with Bitcoin main the cost, attracting $284 million. This uptick additionally impressed inflows into short-Bitcoin funding merchandise.

In line with the most recent CoinShares report, the Federal Reserve’s choice to chop rates of interest by 50 foundation factors final week performed a key position in driving these inflows. The US led regional inflows, contributing $277 million to the entire. This response to the Fed’s fee reduce highlights the rising affect of financial coverage on crypto investments.

“Contemplating our view of Bitcoin as a retailer of worth — albeit an rising one with important volatility — it competes with different shops of worth just like the USD, Treasuries, and gold. Because of this, Bitcoin must be thought to be an interest-sensitive asset, which is obvious in its -70% correlation to the USD. When curiosity rate-sensitive macroeconomic knowledge is launched, we frequently observe a direct intraday response in Bitcoin’s worth. The latest optimistic worth motion was a direct response to the most recent 50 foundation level rate of interest reduce,” CoinShares Head of Analysis James Butterfill informed BeInCrypto.

Learn extra: What Is a Bitcoin ETF?

However, Ethereum (ETH) noticed its fifth consecutive week of outflows, totaling $28.5 million final week. The most recent CoinShares report attributes this to ongoing Grayscale outflows and the underperformance of Ethereum ETFs.

Ethereum ETFs proceed to wrestle, with cumulative internet outflows reaching $607.47 million, in accordance with Sosovalue knowledge. On September 20, Grayscale’s Ethereum ETF (ETHE) reported $2.77 billion in cumulative internet outflows, although different issuers, together with Grayscale’s Mini ETH ETF, posted optimistic flows.

“A number of elements are at play with reference to Ethereum’s underperformance. First, the timing of the ETF launches was unlucky. Second, the broader macroeconomic atmosphere — marked by uncertainty round potential fee cuts, considerations about financial progress, and the unwinding of the yen carry commerce — has not been favorable. Most significantly, ongoing considerations about Ethereum’s profitability on Layer-1 following the Dencun improve have prompted unease,” Butterfill added.

Bitcoin Capital Rotation Into Altcoins

Whereas Bitcoin continues to see rising demand, the long-awaited altcoin season stays delayed as capital has but to circulate into smaller market-cap cash. In line with an analyst on X (previously Twitter), this delay is partly on account of Bitcoin ETFs positioning BTC as an asset in its personal class, creating a definite marketplace for Bitcoin.

Institutional buyers and Wall Road gamers have performed a major position in driving Bitcoin demand, notably following the approval of Bitcoin ETFs in January. Because of this, the concentrate on Bitcoin has slowed the rotation of capital into altcoins, suspending the anticipated altcoin rally.

“Establishments won’t be rotating out of their Bitcoin to play alts. Bitcoin ETF consumers won’t be rotating. Merchants enjoying choices on the Bitcoin ETFs received’t be rotating into shitters. It’s a completely completely different market now and most of you don’t personal any BTC,” one analyst wrote.

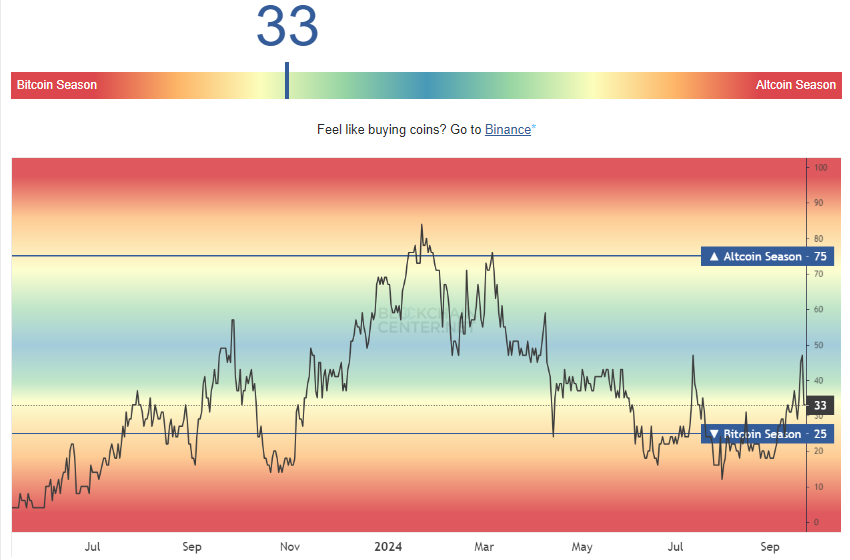

The anticipated “altcoin season” stays at bay, a section when investing in altcoins sometimes yields higher returns than Bitcoin or Ethereum. In line with the Altcoin Season Index, the market continues to be in a Bitcoin season, with a rating of 33/100. This means that Bitcoin continues to dominate, although altcoins are slowly gaining traction.

Learn Extra: What Is Altcoin Season? A Complete Information

Traditionally, altcoin seasons have emerged after Bitcoin dominance peaks, which is why analysts are strategically positioning themselves. If present market situations maintain regular by means of the top of Q3 in September, buyers might lastly witness the beginning of an altcoin season.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.