Bitcoin’s (BTC) value is down 24% since topping out at $71,758 in early June. As sentiment stays soar, the following directional bias for the pioneer cryptocurrency hinges on 4 important narratives that proceed to unfold.

Retail merchants regulate their buying and selling methods primarily based on market sentiment, which explains the extremely unstable nature of crypto.

Important Elements Impacting Bitcoin Worth Now

The $54,450 stage has introduced as a attainable assist for Bitcoin value. Two failed breakdowns after the Relative Power Index (RSI) examined the important threshold of 30 recommend that BTC might have bottomed out.

Nonetheless, whether or not a restoration is sustainable will depend upon how the 4 macro market movers play out.

- Ethereum ETFs Launch May Encourage Constructive Market Sentiment

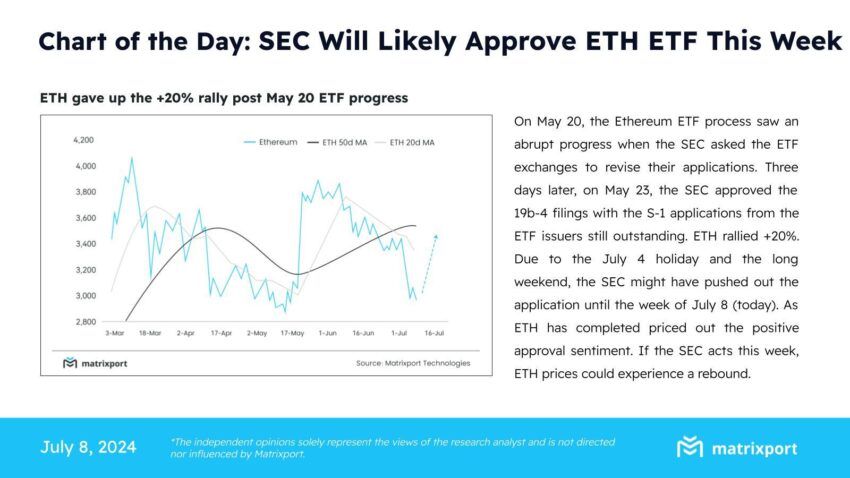

Crypto supporters be part of Ethereum token holders to see whether or not Spot Ethereum ETFs (Alternate-traded funds) will start buying and selling this week. The US Securities and Alternate Fee (SEC) collected closing S-1 Types from potential ETH ETF issuers on Monday. This means progress within the approval course of for these monetary devices.

Crypto monetary companies platform Matrixport shares the optimism. The agency anticipates attainable launches this week because the deadline for issuers to submit amended S-1 filings reaches.

Based on the report, progress might be as swift as in Could, when the regulator green-lit the 19b-4 varieties solely three days after submissions.

Together with the anticipated launch, the Matrixport report anticipates a 12% restoration within the Ethereum value to $3,400. This hypothesis comes as ETH jumped 20% in Could after approval of 19-b filings. Bullish sentiment from an approval is predicted to spill over to Bitcoin, supporting a restoration.

Additionally Learn: Ethereum ETF Defined: What It Is and How It Works

2. Mt. Gox Influence Could Already Be Priced In

Anxiousness round Mt. Gox repayments continues to fade because the market has already accounted for or priced within the impression. Mt. Gox Rehabilitation Trustee initiated repayments in Bitcoin and Bitcoin Money (BCH) final week.

Bitstamp change, in settlement with Mt. Gox, indicated that it’s going to be sure that traders are compensated as quickly as attainable. It highlighted a 60-day timeline for token distribution, with some collectors already confirming receipt. Kraken, one of many 5 exchanges the trustee will use for reimbursement, has a 90-day timeline.

Japan’s Bitbank and SBI VC Commerce exchanges have already obtained and reportedly distributed their allotted funds. In so doing, they successfully beat their 14-day timeline. As creditor reimbursement by the defunct change’s trustee continues, optimism continues to be restored out there.

This might bode effectively for Bitcoin value, particularly if collectors don’t money in upon reception.

“Many of those collectors are long-term Bitcoiners, early adopters who’re technologically adept and have beforehand rejected aggressive gives to liquidate their claims for money,” Alex Thorn, Galaxy’s head of analysis opined.

3. German Authorities’s Bitcoin Promote-off

Since June 19, the German authorities has moved greater than 10,000 BTC. That is value virtually $1 billion in Bitcoin moved to numerous crypto wallets and exchanges. This catalyzed the latest Bitcoin sell-off as traders front-run a attainable provide shock.

Nonetheless, primarily based on Arkham knowledge, token balances are depleting within the govenment’s reserve.

There may be hypothesis that the German authorities will finally decelerate on Bitcoin transactions, which may play in favor of the flagship crypto asset. One of many nation’s MPs, Joana Cotar, who’s a famend crypto activist, mentioned German’s native media had captured the decision out, with traders within the nation expressing anger.

“The German press picks it up,” Cotar wrote.

Learn extra: Who Owns the Most Bitcoin in 2024?

4. Federal Reserve Chair Testimony This Week

Inflation is steadily decelerating within the US, and the nation’s economic system is displaying power however remains to be far-off from passable ranges. With these, a gentle touchdown appears doubtless, particularly after the July 5 constructive payroll knowledge. The Federal Reserve’s long-awaited pivot in financial coverage now seems to be like a chance.

“Fed’s newest projections are conserving traders cautious. Fewer charge cuts than hoped for are placing strain on riskier property. Political uncertainty in Europe and a stronger USD are pushing BTC down,” a well-liked account on X wrote.

Crypto markets proceed to really feel the warmth of those macro occasions. This week is important as Fed Chair Jerome Powell prepares to handle Congress on July 9 and 10.

Disclaimer

In keeping with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.