BlackRock, the world’s largest asset supervisor, is looking for to amend its Bitcoin ETF (IBIT), which has been the top-performing ETF amongst its friends since launching on January 11.

Bitcoin ETFs proceed to draw institutional demand, bringing Bitcoin publicity to Wall Avenue and increasing its attain past retail buyers.

BlackRock Information Bitcoin ETF Modification

In a submitting with the US Securities and Change Fee (SEC) on September 16, BlackRock requested that Bitcoin withdrawals from Coinbase, which acts as custodian for the asset supervisor’s IBIT, be processed inside 12 hours.

“Topic to affirmation of the foregoing required minimal steadiness, Coinbase Custody shall course of a withdrawal of Digital Property from the Custodial Account to a public blockchain handle inside 12 hours of acquiring an Instruction from Shopper or Shopper’s Licensed Representatives,” an excerpt within the submitting learn.

This request comes as buyers elevate considerations about Coinbase’s custodial practices for Bitcoin ETFs. Particularly, buyers need Coinbase, as custodian, to supply on-chain proof of Bitcoin purchases for ETFs to make sure transparency.

The considerations have arisen because of Bitcoin’s stagnant value efficiency over the previous three months, regardless of giant inflows into Bitcoin ETFs. Some speculate that Coinbase could be utilizing “paper BTC” or Bitcoin IOUs for ETF issuers, probably contributing to the lackluster value motion.

Learn extra: How To Commerce a Bitcoin ETF: A Step-by-Step Method

Amidst the considerations, Coinbase CEO Brian Armstrong pushed again in a daring try to counter concern, uncertainty, and doubt (FUD).

“All ETF mints and burns we course of are finally settled onchain. Institutional purchasers have commerce financing and OTC choices earlier than trades are settled onchain. That is the norm for all our institutional purchasers. All funds are settled in our Prime vaults (onchain) inside about one enterprise day,” Armstrong wrote.

In hindsight, Tron founder Justin Solar first raised considerations by questioning Coinbase’s Bitcoin wrapper, cbBTC, and criticized the alternate for missing proof of reserves, warning it may mark “darkish days for Bitcoin.”

BlackRock’s latest transfer to amend its Bitcoin ETF goals to deal with these considerations. The modifications recommend the asset supervisor’s efforts to boost operational frameworks whereas enhancing liquidity. ETF analyst Eric Balchunas additionally minimized the hypothesis.

“I get why these theories exist and folks wish to scapegoat the ETFs. As a result of it’s too unthinkable that the native HODLers could possibly be the sellers. However they’re… All of the ETFs and BlackRock have finished is save BTC’s value from the abyss repeatedly,” Balchunas stated.

Coinbase as a Potential Single Level Of Assault

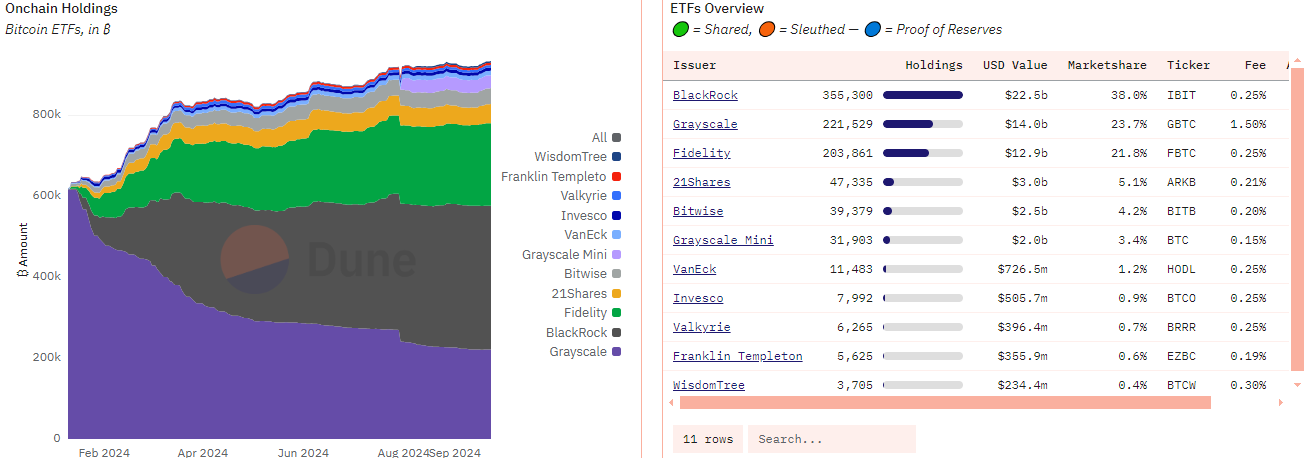

Certainly, Bitcoin ETF inflows have been huge for the reason that monetary instrument hit markets on January 11. Dune information exhibits that BlackRock’s IBIT dominates the sector, holding over 38% of the market share and managing $22.5 billion in on-chain property.

Learn extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

Coinbase performs a dominant position within the crypto spot ETFs market, offering custody providers for eight of 11 Bitcoin ETFs and eight of 9 Ethereum ETFs. It additionally provides buying and selling execution and market surveillance providers.

Coinbase manages round 90% of the $37 billion in Bitcoin ETF property, resulting in considerations about its place as a possible single level of failure. Fox Enterprise reporter Eleanor Terrett, amongst others, not too long ago raised concern about this place of affect.

“It doesn’t bode properly that almost all crypto ETF issuers have the identical custodian for all their BTC and ETH. This makes Coinbase a possible single level of failure and that’s scary,” Terrett wrote.

Past the most recent considerations about doable IOUs to buyers, the risk from North Korean hackers additionally positions Coinbase as a single level of assault ought to the unhealthy actors goal the custodian. Regardless of these considerations, the platform continues to play a crucial position in institutional Bitcoin funding, working a considerable portion of the US-based BTC spot buying and selling market.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.