Fast Take

Information unveiled throughout Asia hours from Coinbase revealed a large withdrawal of over 18,000 Bitcoin, as confirmed by Arkham Intelligence, Glassnode, and Coinglass.

This substantial outflow of practically $1 billion has considerably influenced Coinbase’s alternate steadiness. The funds have been despatched to a number of totally different addresses with the Bitcoin break up throughout new wallets. Balances within the new wallets vary from $45 million to $171 million, with all UTXOs from the unique transaction having been spent.

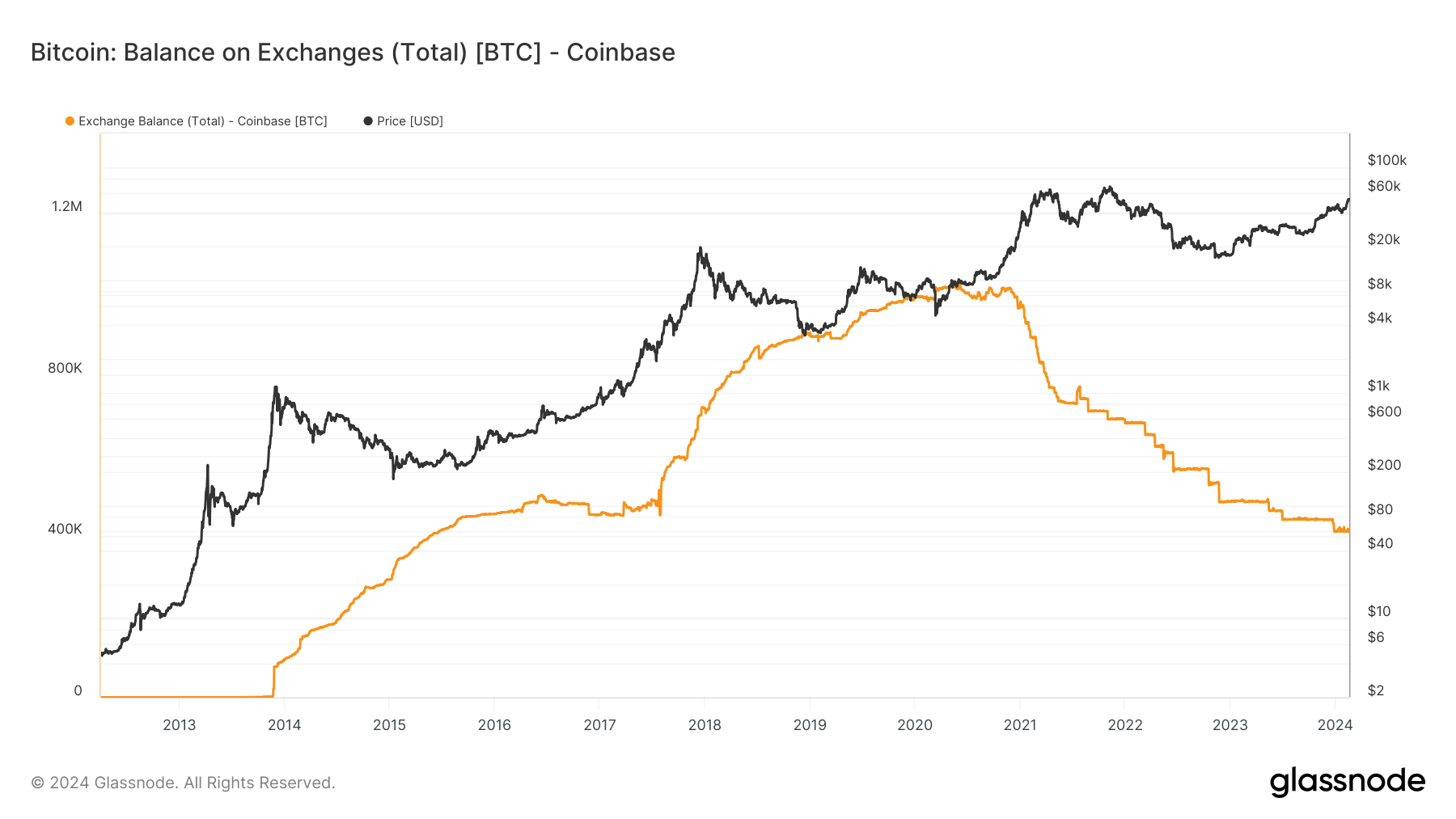

Exactly, the alternate now homes roughly 390,000 Bitcoin, valued at round $20.5 billion. This steadiness represents lower than 2% of the overall Bitcoin provide on exchanges. Curiously, that is the bottom proportion Coinbase has held since 2015, marking a shift within the alternate’s holding patterns, in keeping with Glassnode.

Nonetheless, you will need to make clear that the motivation for the switch is as but unconfirmed, and the Bitcoin has been transferred to wallets that knowledge suppliers don’t tag. UTXO administration appears a probable possibility; nevertheless, it is usually doable that the funds will present new liquidity for OTC desks or that the funds have been bought and transferred into self-custody.

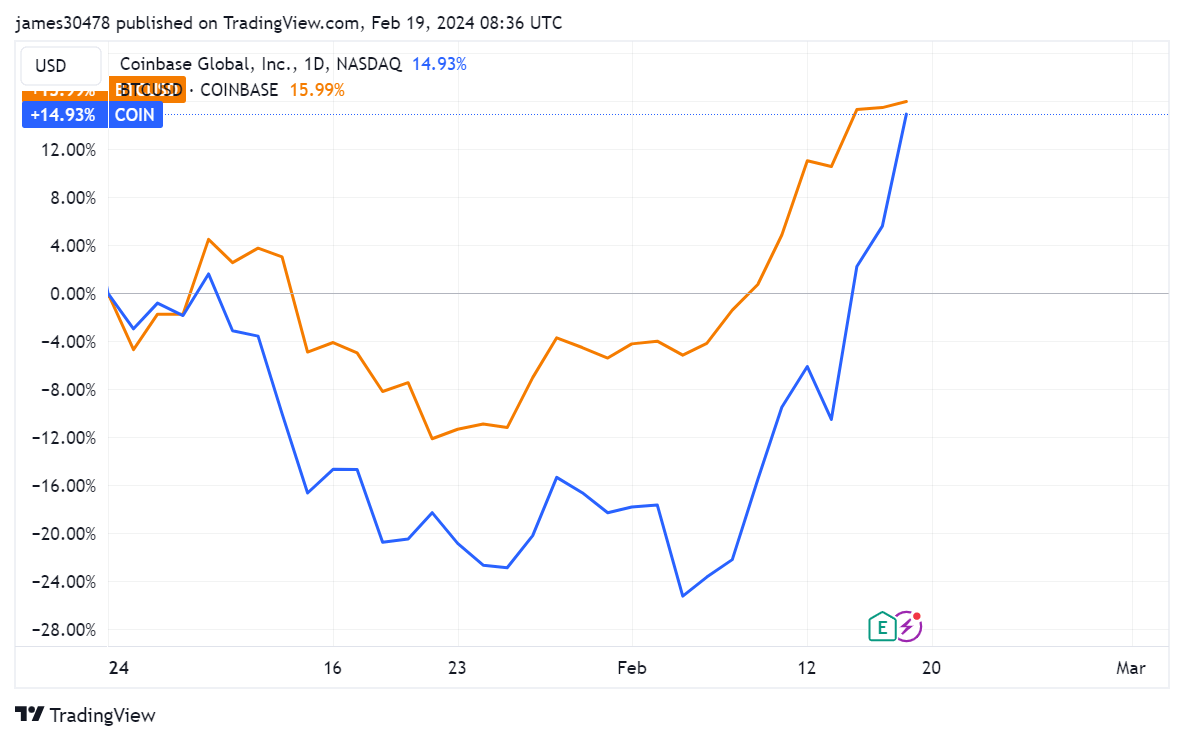

Coinbase’s monetary efficiency additionally appears to show a bullish narrative. The alternate reported This autumn 2023 earnings, declaring a complete income of $3.1 billion for 2023, with This autumn contributing to one-third of that complete.

Consequently, Coinbase has skilled a 15% enhance in its share value for the reason that begin of the 12 months.

The put up Coinbase sees main Bitcoin withdrawal, holds lowest confirmed provide since 2015 appeared first on CryptoSlate.