Constancy Investments’ Director of World Macro, Jurrien Timmer, explains the latest slowdown in Bitcoin adoption.

Whereas he acknowledges Bitcoin as “exponential gold” and a possible retailer of worth, Timmer highlights the divergence between the deceleration in Bitcoin’s community progress and its worth actions.

Community Progress vs. Value Features

Timmer emphasised that Bitcoin’s worth is primarily pushed by its community progress, influenced by its shortage, financial and financial insurance policies, and market sentiment. Regardless of Bitcoin’s worth beneficial properties, its community progress has slowed. Such a dynamic created a divergence which will clarify the latest slowdown in adoption.

In his tweets, Timmer illustrated how Bitcoin and Ethereum’s progress curves mirror historic technological developments. He famous that Bitcoin’s community, represented by the variety of non-zero addresses, has adopted an influence curve, with worth oscillating round it. He additional added that this boom-bust cycle is exclusive to Bitcoin.

Learn extra: How To Purchase Bitcoin (BTC) and Every part You Want To Know

“In my opinion, this divergence between worth and adoption may clarify why Bitcoin has slowed down a bit alongside its path to potential new all-time highs. The pendulum will solely swing thus far. For the brand new highs to proceed, the community might must speed up once more. May this be pushed by the subsequent chapter within the fiscal dominance thesis (i.e., financial subordination)?” Timmer wrote.

Veteran dealer Peter Brandt responded to Timmer’s insights by highlighting the diminishing beneficial properties in every bull market cycle. Brandt recommended that if the sample continues, the present advance is perhaps nearing its finish.

“It is smart, given the asymptotic nature of the facility curve and the trail of worth discovery in the direction of a mature asset,” Timmer replied to Brandt’s perspective.

Why Bitcoin’s Gradual Circulation Might Not Be a Dangerous Factor

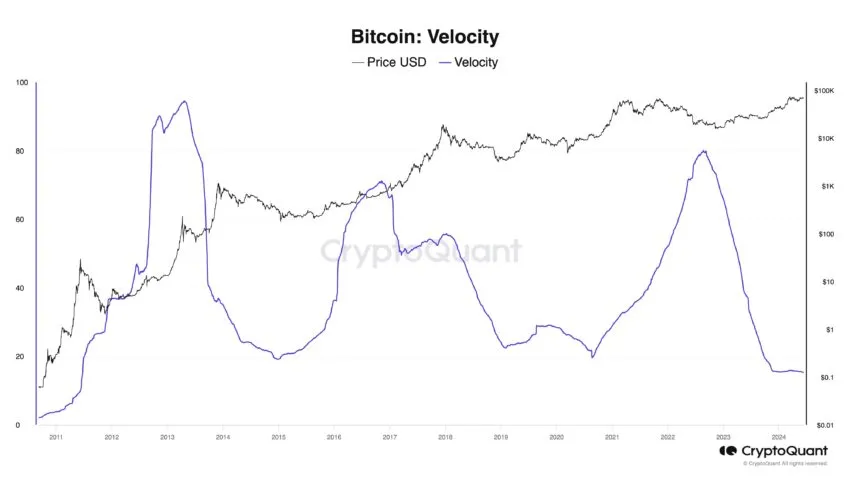

Ki Younger Ju, founder and CEO of on-chain analytics platform CryptoQuant, additionally supplied insights. Ju pointed out that Bitcoin’s circulation velocity has reached its lowest level since 2013. Nonetheless, he thinks its velocity will peak sometime when BTC is broadly used for funds.

He argued that whereas Bitcoin was initially supposed as “P2P Digital Money,” it has advanced into “Digital Gold,” with establishments holding it with out frequent transactions. This shift in utilization signifies that conventional Bitcoin adoption metrics might now not be as related.

“With the rise of custodial wallets like ETFs, funds are concentrated in a couple of wallets. To evaluate the adoption curve precisely, separating cohorts for Bitcoin transactions as funds or utilizing op_code to measure software utilization is perhaps more practical,” Ju famous.

Learn extra: The best way to Spend money on Bitcoin?

Ju’s views align with the broader tendencies of institutional curiosity in Bitcoin investments. For example, Canadian fintech DeFi Applied sciences not too long ago introduced that it has adopted Bitcoin as the corporate’s treasury reserve, with an preliminary buy of 110 BTC.

Equally, since April, Japanese funding agency Metaplanet has adopted Bitcoin as its “core treasury reserve asset.” On June 11, the corporate introduced that it had acquired one other 23.35 BTC to its steadiness sheet, bringing its Bitcoin holdings to 141.07 BTC.

Certainly, consultants’ insights and the present development from institutional traders clarified the divergence between Bitcoin’s worth and its community progress. Nonetheless, the altering makes use of of Bitcoin and the rising curiosity from establishments point out that its story is way from completed.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.