Crypto funding inflows surged to $2.2 billion final week, the best since July 2023. Consultants ascribe this development to mounting optimism over a possible Republican win within the upcoming US elections.

This shift in political expectations has boosted each investor confidence and market costs.

Crypto Inflows at Multi-Month Highs Amid US Election Buzz

After recording $407 million in constructive flows for the week ending October 11, digital asset funding inflows reached 2.2 billion final week. This represents a 5 instances development week-over-week, with Bitcoin seeing the biggest inflows at $2.13 billion.

Constructive flows into Ethereum reached $57.5 million. In the meantime, multi-asset inflows interrupted their 17 consecutive week influx streak to document $5.3 million in outflows.

Just like the week earlier than, CoinShares analysts ascribe the rising curiosity to the upcoming US elections, on condition that the US led the cost with inflows totaling $2.3 billion.

“We consider this renewed optimism stems from rising expectations of a Republican victory within the upcoming US elections, as they’re usually considered as extra supportive of digital belongings. This, in flip, has led to constructive worth momentum,” a paragraph within the report learn.

Learn extra: How Can Blockchain Be Used for Voting in 2024?

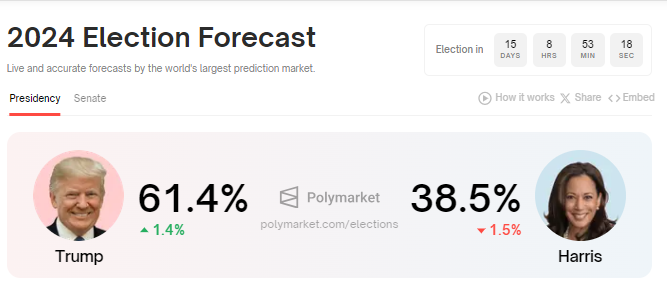

In accordance with CoinShares researchers, this highlights a rising curiosity in crypto investments inside the nation. It comes because the US election countdown continues, with solely 15 days left. In accordance with Polymarket, pro-crypto candidate Donald Trump is within the lead with a 22.9 share level distinction towards Kamala Harris.

With the Republican candidate usually perceived as being supportive of the cryptocurrency sector, the overall sentiment is a possible Donald Trump victory may result in extra crypto-friendly laws.

As BeInCrypto reported, the Republican presidential aspirant has plans to overtake US crypto guidelines past Gary Gensler. This may gas market development additional amidst beliefs that the get together might introduce insurance policies helpful to the cryptocurrency business.

Because the countdown continues, investor curiosity in crypto can also be rising. The report indicated a 30% improve in buying and selling volumes in digital asset funding merchandise final week. The uptick in buying and selling exercise, mixed with rising asset costs, has introduced whole belongings underneath administration (AUM) within the digital asset house to just about $100 billion.

If the present momentum continues, the market may quickly cross this milestone. Crypto funding inflows may additionally improve this week in comparison with final week.

“A constructive regulatory surroundings may open the floodgates for institutional funding. If the US sees a management shift that’s supportive of crypto innovation, it may result in clear pointers for crypto companies, a possible inexperienced gentle for ETFs, and institutional confidence, resulting in a wave of recent capital into crypto markets,” an analyst wrote on X (previously Twitter).

Learn extra: How To Purchase Bitcoin (BTC) and All the things You Want To Know

In the meantime, BeInCrypto knowledge reveals Bitcoin is eying the $70,000 psychological stage, buying and selling for $68,210 as of this writing.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.