Crypto funding inflows reached $901 million final week, a major setback from the earlier week’s optimistic flows. Nonetheless, it provides to the collection of inflows because the political local weather intensifies within the run-up to the US elections.

Amongst digital belongings, Bitcoin attracted almost all consideration, drawing in $920 million in inflows. Notably, this shift didn’t lengthen to short-Bitcoin positions, which skilled minor outflows totaling $1.3 million. This means traders’ prevailing confidence in Bitcoin’s upward trajectory.

Political Momentum Boosts Crypto Funding Inflows

Amid heightened anticipation of potential political shifts within the US, digital asset funding merchandise have continued with optimistic flows. The newest CoinShares report reveals an inflow of $901 million into these belongings.

With these numbers, October is successfully the fourth-largest month on report for inflows, bringing this yr’s cumulative inflows to $27 billion. Noteworthy, that is almost triple the earlier excessive of $10.5 billion set in 2021.

The traction highlights the elevated enthusiasm round cryptocurrency investments because the election cycle within the US intensifies. Particularly, the majority of this month’s inflows, amounting to $906 million, originated within the US, setting a stark disparity in opposition to different areas.

Learn extra: How To Purchase Bitcoin (BTC) and Every thing You Want To Know

CoinShares’ researcher James Butterfill ascribes to the affect of home political developments within the US on the crypto market. Particularly, the researcher highlights politics-centric elements driving the present surge, notably the upcoming 2024 presidential election.

“We imagine that present Bitcoin costs and flows are closely influenced by US politics, with the current surge in inflows doubtless linked to the Republicans ballot good points,” a paragraph within the report reads.

The final sentiment is that the Republican facet of the political divide may alter regulatory and tax insurance policies in ways in which may benefit the digital asset house. This correlation was evident over the past two weeks, with crypto funding inflows hovering to $2.2 billion within the week ending October 18 and $406 million within the week ending October 11, as reported by BeInCrypto.

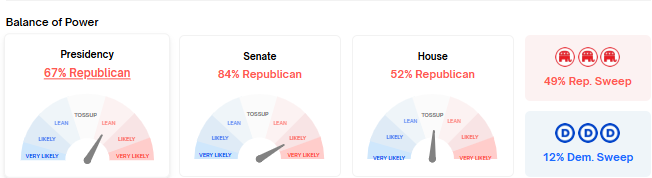

The intensified curiosity in cryptocurrency correlates with current polling shifts favoring Republicans. The swing states, traditionally pivotal in figuring out election outcomes, have additionally influenced investor sentiment. In response to information from the Polymarket prediction market, Republicans are exhibiting power in a number of of those key states on the steadiness of energy metrics, which may additional amplify crypto funding inflows if this pattern continues.

Equally, Donald Trump at the moment leads on the prediction market, standing at 66.2% in head-to-head polls in opposition to Democratic Celebration presidential aspirant Kamala Harris, who trails at 33.7%. In the meantime, the countdown exhibits People are simply over per week away from the US elections.

With a possible political shift on the horizon, the cryptocurrency market is poised to draw continued curiosity. Buyers are maintaining an in depth eye on US election polls.

Learn extra: How Can Blockchain Be Used for Voting in 2024?

Of notice, past demonstrating a resurgence in Bitcoin, these sustained collection of crypto funding inflows spotlight how political developments may form the cryptocurrency enjoying subject within the days forward. As political sentiment good points momentum, traders are more and more viewing Bitcoin as a viable hedge in opposition to financial uncertainties.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.