As Bitcoin’s value retraces, giant holders referred to as whales are seizing the second, quietly accumulating whereas retail buyers offload in worry.

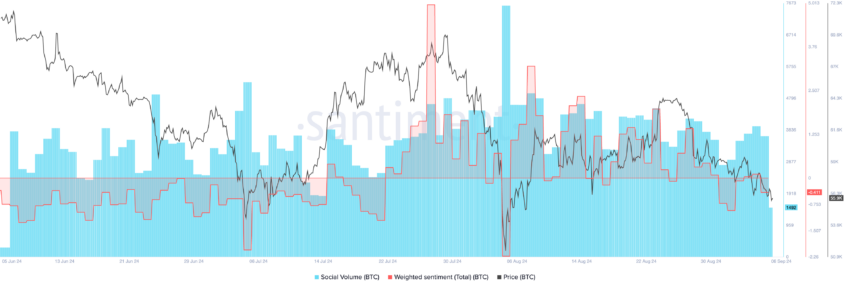

This development, highlighted by information from Santiment, means that these influential gamers are seeing alternative within the latest market downturn, at the same time as headlines proceed to warn of crashes and bear markets.

Bitcoin Whales on a Shopping for Spree

Brian Quinlivan, Lead Analyst at Santiment, notes a major uptick in whale accumulation over the previous three months. In keeping with Santiment’s information, Bitcoin wallets holding not less than 10 BTC have elevated their balances by 34,200 BTC, price roughly $2.15 billion, since June, regardless of the worth volatility.

“On high of individuals spouting that we’re in a bear market and a crash is coming, we now have whales principally scooping up hordes of cash whereas everyone seems to be panicking,” Quinlivan mentioned.

This means that whales are assured in Bitcoin’s long-term potential, at the same time as small-scale buyers succumb to market jitters. Researchers at Bybit notice that such a bullish development can also be noticed within the Bitcoin choices markets.

“Bearish sentiment is robust in BTC choices markets, with places now exhibiting extra open curiosity than calls. This development can also be mirrored in ETH, although name choices stay barely forward, hinting at extra cautious optimism in Ether markets,” Bybit researchers wrote.

Traditionally, durations of excessive worry and panic promoting usually present shopping for alternatives for many who perceive market cycles. Quinlivan emphasizes that crowd habits generally is a contrarian sign. When retail buyers promote in worry, whales take benefit, shopping for at decrease costs.

This sample aligns with historic precedents, the place vital whale accumulation throughout downtrends precedes value recoveries.

“We had the largest spike in unfavorable key phrases since that huge August crash final month… it ended up being the last word time to purchase,” Quinlivan added.

One other key indicator supporting whale confidence is the decline within the provide of Bitcoin on exchanges. This displays a long-term maintain technique, as buyers transfer their property to chilly wallets, lowering the danger of panic promoting.

Learn extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

Whereas smaller buyers could also be deterred by latest volatility, information means that seasoned market individuals are capitalizing on the worry. Their actions point out optimism about Bitcoin’s future, particularly as This autumn traditionally brings constructive value momentum.

Disclaimer

Consistent with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.