Nayib Bukele, President of El Salvador, has proudly showcased the nation’s Bitcoin (BTC) income sources as its portfolio soared to a exceptional $84 million revenue. This announcement comes amid Bitcoin’s climb to unprecedented highs.

El Salvador’s strategic funding in Bitcoin has positioned it as a trailblazer within the digital forex sphere.

El Salvador’s Bitcoin Technique

Since 2021, El Salvador has aggressively bought Bitcoin, buying a complete of two,861 BTC at a mean worth of $42,599 every. Consequently, these belongings at the moment are value over $206 million, reflecting a major uptick of 69.09% in portfolio worth. Importantly, the nation’s revenue isn’t solely from market appreciation. It additionally stems from revolutionary income streams straight tied to Bitcoin.

El Salvador’s Bitcoin income is derived from a number of key initiatives. These embody the nation’s passport program, conversion providers from BTC to USD for native companies, state-operated Bitcoin mining, and Bitcoin-based authorities service funds. Such initiatives exhibit a holistic strategy to leveraging cryptocurrency for financial development.

Learn extra: Who Owns the Most Bitcoin in 2024?

Moreover, El Salvador has launched insurance policies to encourage Bitcoin funding. In December 2023, a brand new migration regulation was handed, providing expedited citizenship to foreigners who donate Bitcoin to assist the nation’s improvement.

Bukele’s re-election in February, by a large margin, underscores the general public’s assist for his Bitcoin technique. Regardless of prior criticisms, particularly throughout Bitcoin’s worth dips, Bukele remained unwavering. He has identified the media’s give attention to the nation’s short-term setbacks, difficult the narrative of loss.

“They lie and lie and lie, and when their lies are uncovered, they go on silence mode,” Bukele criticized mainstream media.

In January, Bukele introduced the entire compensation of a $800 million debt, together with curiosity. This achievement aligns with the federal government’s plans to construct a tax-free haven and provoke Bitcoin bonds. These initiatives had been paused on account of market volatility however at the moment are set to proceed.

El Salvador additionally goals to assemble a Bitcoin Metropolis, revitalizing a proposal made throughout the 2021 bull market. This plan is gaining momentum, reflecting the nation’s dedication to turning into a cryptocurrency innovation hub.

Crypto Funding Product Inflows

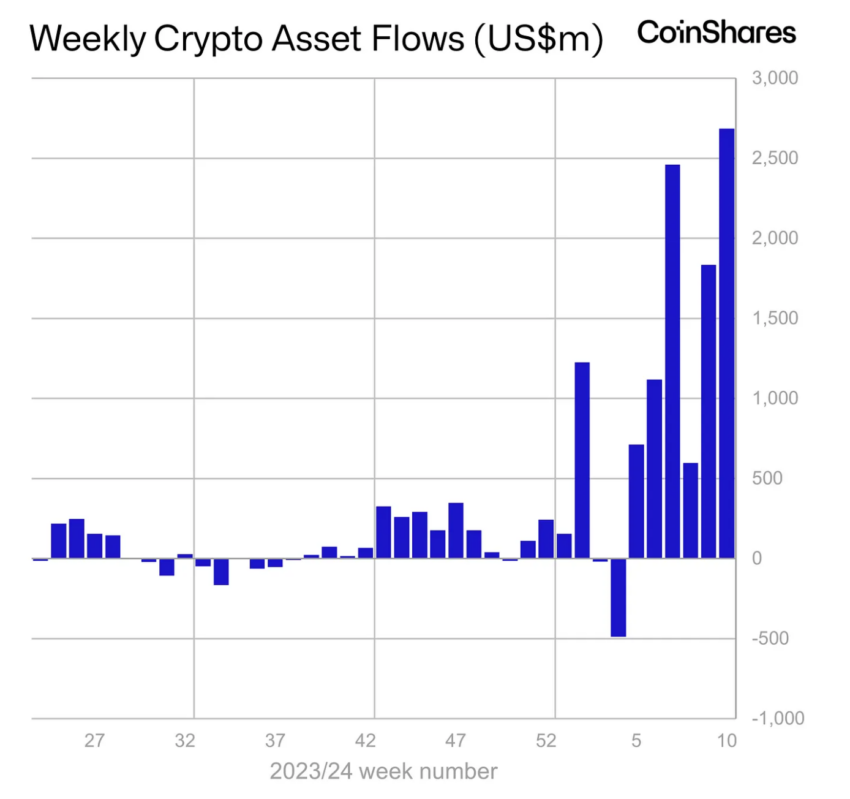

The worldwide curiosity in Bitcoin and cryptocurrencies has been additional highlighted by a latest crypto asset influx report. In line with CoinShares, a report $2.7 billion flowed into crypto belongings final week, the majority of which focused Bitcoin.

This unprecedented inflow is propelled by a mixture of things, together with the US Securities and Change Fee’s approval of spot Bitcoin exchange-traded funds (ETFs) and anticipation of the upcoming halving occasion in April, which is predicted to scale back the availability of recent Bitcoin by half.

Because the 12 months’s begin, roughly $10.3 billion has been poured into crypto belongings, nearing the $10.6 billion whole influx recorded all through 2021. BlackRock and Constancy Funding’s spot Bitcoin ETFs have considerably attracted investments into the crypto market. These choices have helped stability the outflows from Grayscale Investments’ Bitcoin ETF since its conversion from a belief in January.

Learn extra: Bitcoin Halving Cycles and Funding Methods: What To Know

Regardless of the latest worth surges, the report factors out a continued curiosity in brief Bitcoin positions, indicating that some buyers are hedging in opposition to potential corrections.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.