Spot Ethereum ETFs recorded a sturdy buying and selling debut within the US on July 24 after months of hypothesis and regulatory uncertainty.

The ETFs recorded a formidable quantity of $1.11 billion on the primary buying and selling day, led by BlackRock’s $266.5 million inflows. Throughout the first 90 minutes of buying and selling, ETH ETFs recorded $361 in buying and selling quantity, reflecting sturdy curiosity and confidence in Ethereum.

Whereas the first-day buying and selling quantity for Ethereum ETFs nonetheless represents round 1 / 4 of the amount Bitcoin ETFs noticed upon launch, it’s nonetheless a serious improvement for ETH. Except for a short spike in spot worth, the surge in curiosity for ETFs has additionally affected the derivatives market.

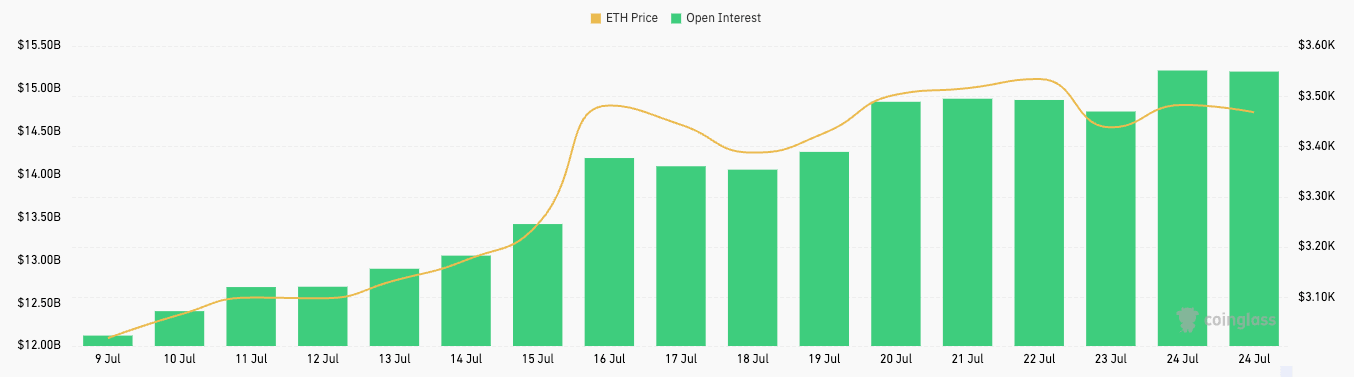

Ethereum derivatives noticed a risky June however had a comparatively calm July. Over the previous week, your complete derivatives market noticed gradual however noticeable progress that appears to have sped up after the ETFs launched. Information from CoinGlass confirmed a gentle climb in choices open curiosity, notably on July 24, when it reached $7.39 billion.

Ethereum futures adopted the same pattern, albeit the bigger dimension of the market meant that the $460 million enhance in open curiosity didn’t present up as such a major uptick.

An increase in open curiosity is important because it usually brings about elevated liquidity and buying and selling quantity, offering Ethereum with a extra sturdy market construction. Because the buying and selling exercise round ETH ETFs heats up within the coming weeks, we will count on the derivatives market to proceed its upward trajectory.

The rising institutional curiosity in ETH ETFs may very nicely translate into derivatives. Institutional and complicated traders may start using foundation commerce methods, resulting in a rise in derivatives OI and quantity.

Foundation buying and selling is a classy technique that entails making the most of the value distinction between the spot and futures market. It has change into a major a part of the Bitcoin market, particularly after the launch of Bitcoin ETFs. Earlier CryptoSlate evaluation discovered that the Bitcoin foundation commerce has considerably influenced the market, resulting in flat worth motion that defies the inflows and quantity seen in spot ETFs. With the introduction of Ethereum ETFs, the same factor may additionally occur within the ETH market.

Whereas this buying and selling technique suppresses any vital worth motion, it may bode nicely for Ethereum by growing OI, making a extra liquid and energetic derivatives market. Such a market enhances worth discovery and threat administration capabilities.

Nonetheless, if a foundation commerce involving Ethereum ETFs and derivatives positive aspects lots of traction, it may negatively have an effect on the market. Essentially the most vital threat for Ethereum comes from the potential for market manipulation, the place massive institutional gamers may exploit discrepancies to govern costs.

Moreover, if the premise commerce turns into too crowded, it may cut back the technique’s profitability, resulting in abrupt exits and doubtlessly triggering sharp corrections. Given the dimensions of Ethereum’s DeFi market, this might show particularly harmful for the coin.

The publish Ethereum open curiosity grows as market hype grows round spot ETFs appeared first on CryptoSlate.