Right now, a pockets labeled as “German Authorities (BKA)” by Arkham, a crypto on-chain analytics agency, initiated substantial Bitcoin (BTC) transactions. These actions have sparked widespread curiosity throughout the crypto group.

The crypto group speculates that the German authorities would possibly liquidate a few of its BTC property.

German Authorities Sends 1,000 Bitcoin (BTC) to Centralized Crypto Exchanges

The Bitcoin pockets transferred roughly 6,500 BTC, with a staggering worth exceeding $425.49 million. Beforehand, the German authorities’s Bitcoin pockets maintained a stability near 50,000 BTC.

Arkham’s evaluation suggests that these funds have been possible seized from the operator of the defunct pirated film web site, Movie2k. Just like different governments worldwide, Germany seizes digital property from legal actions and sometimes auctions them off. For instance, the US authorities has auctioned vital quantities of Bitcoin beforehand seized from the notorious Silk Highway darkish internet market.

Round six hours in the past, the German government-affiliated pockets executed three vital transactions. Initially, it despatched 6,500 BTC to a brand new pockets tackle labeled “bc1q0.” Moreover, it transferred 2,359 BTC inside its personal addresses.

Learn extra: How To Make Cash With Intel-To-Earn on Arkham Intelligence

Subsequently, the bc1q0 pockets moved 2,500 BTC to a different tackle, “bc1qq.” This pockets then distributed 500 BTC every to varied recipients, together with the crypto exchanges Kraken and Bitstamp, in addition to two unknown Bitcoin addresses. Nevertheless, it nonetheless holds the remaining 500 BTC value $32.64 million.

Regardless of these giant transactions, the first pockets nonetheless holds 43,359 BTC, valued at roughly $2.83 billion. Intriguingly, only one,000 BTC has been moved to centralized exchanges, presumably for promoting. Crypto dealer Daan suggests that this motion brought about a slight dip in Bitcoin costs.

“The precise BTC despatched to Bitstamp and Kraken was about 500 BTC every, to date so nothing loopy there. The submit was simply meant to focus on to not name for an enormous pump/dump or something,” Daan elaborated.

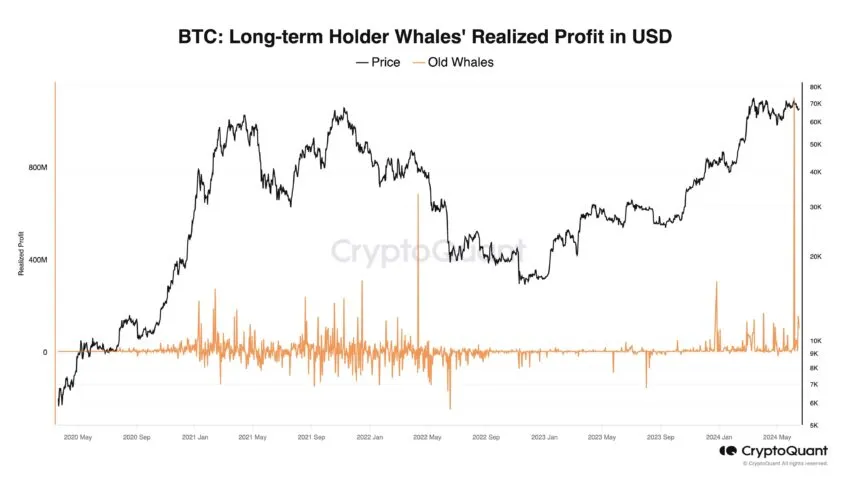

Though these transactions didn’t considerably influence Bitcoin’s worth, different market dynamics trace at potential promoting pressures. In response to Ki Younger Ju, co-founder of CryptoQuant, long-term Bitcoin holder whales have bought off $1.6 billion value of property within the final two weeks, possible via brokers.

“If this ~$1.6 billion in sell-side liquidity isn’t purchased over-the-counter, brokers could deposit BTC to exchanges, impacting the market,” Ju warned.

Learn extra: Who Owns the Most Bitcoin in 2024?

Moreover, there was notable exercise in spot Bitcoin ETFs. Particularly, spot Bitcoin ETFs noticed a web outflow of $152.4 million on Tuesday.

The majority of this motion originated from Constancy Clever Origin’s Bitcoin ETF (FITB), with an $83.1 million outflow. Grayscale’s Bitcoin Belief (GBTC) adopted, recording a $62.3 million lower.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.