Be part of Our Telegram channel to remain updated on breaking information protection

Analysts are advising buyers to think about “shopping for the dip” within the altcoin market, as a technical sample on the weekly chart signifies a possible bullish reversal. This sample seems after a prolonged accumulation part, suggesting that costs might quickly rise. Consequently, this could be one of many closing probabilities to accumulate altcoins at decrease costs earlier than a market upswing happens.

Moreover, elevated buying and selling volumes for cryptocurrencies like WIF, PEPE, SOL, and FTM replicate rising investor curiosity throughout these value dips. Nonetheless, profit-taking and warning have led to non permanent decreases in market capitalization as buyers consider their dangers. This evaluation focuses on a few of the finest cryptocurrencies to put money into proper now.

Greatest Cryptocurrencies to Spend money on Proper Now

Aave has just lately linked its algorithmic stablecoin with Chainlink’s Cross-Chain Interoperability Protocol (CCIP), aimed to simplify the cross-chain switch of the GHO stablecoin. In the meantime, Memebet has raised greater than $525,000 in its presale, producing vital curiosity amongst buyers. Moreover, the proposed partnership between Injective and Fetch.AI has garnered consideration throughout the crypto group.

1. Aave (AAVE)

Aave has just lately built-in its algorithmic stablecoin, GHO, with Chainlink’s Cross-Chain Interoperability Protocol (CCIP). This partnership goals to facilitate simpler, cross-chain motion of the GHO stablecoin, which is pegged to the US greenback. Since its launch, GHO has proven promising traction, accumulating $31.2 million in bridged quantity.

This makes GHO the second-largest asset by quantity on Chainlink’s CCIP, underscoring its early adoption and potential development within the stablecoin market. The GHO launch aligns with Aave’s aim of enhancing cross-chain liquidity and enhancing stability for the stablecoin’s ecosystem.

At present, the AAVE token trades at $139.78, marking a 5.97% decline. Nonetheless, the token’s buying and selling quantity has surged 72.75% to $182.99 million in a single day, which signifies a rise in market exercise. The Relative Power Index is 49.29, a impartial place that means neither oversold nor overbought circumstances.

GHO is now out there as a payment token for bridging any token by way of @Chainlink CCIP, providing customers a less complicated approach to switch GHO throughout supported networks. pic.twitter.com/DKhbaxtDdG

— Aave Labs (@aave) October 21, 2024

This neutrality within the RSI displays that AAVE’s value might see potential motion in both path. With this backdrop, a slight dip might precede a possible breakout if shopping for momentum will increase.

In the meantime, trade reserves for AAVE tokens have risen by 0.55% to 2.6578 million. A rise in trade reserves sometimes indicators that extra tokens are being held on exchanges, which regularly results in heightened promoting strain. If this pattern persists, it might hinder any upward value motion for AAVE within the close to time period.

2. Cronos (CRO)

Cronos (CRO) is a blockchain constructed to help Crypto.com’s ecosystem, specializing in cost, buying and selling, and monetary companies. By enhancing its utility, Cronos seeks to create a smoother expertise for customers, particularly throughout the Crypto.com platform.

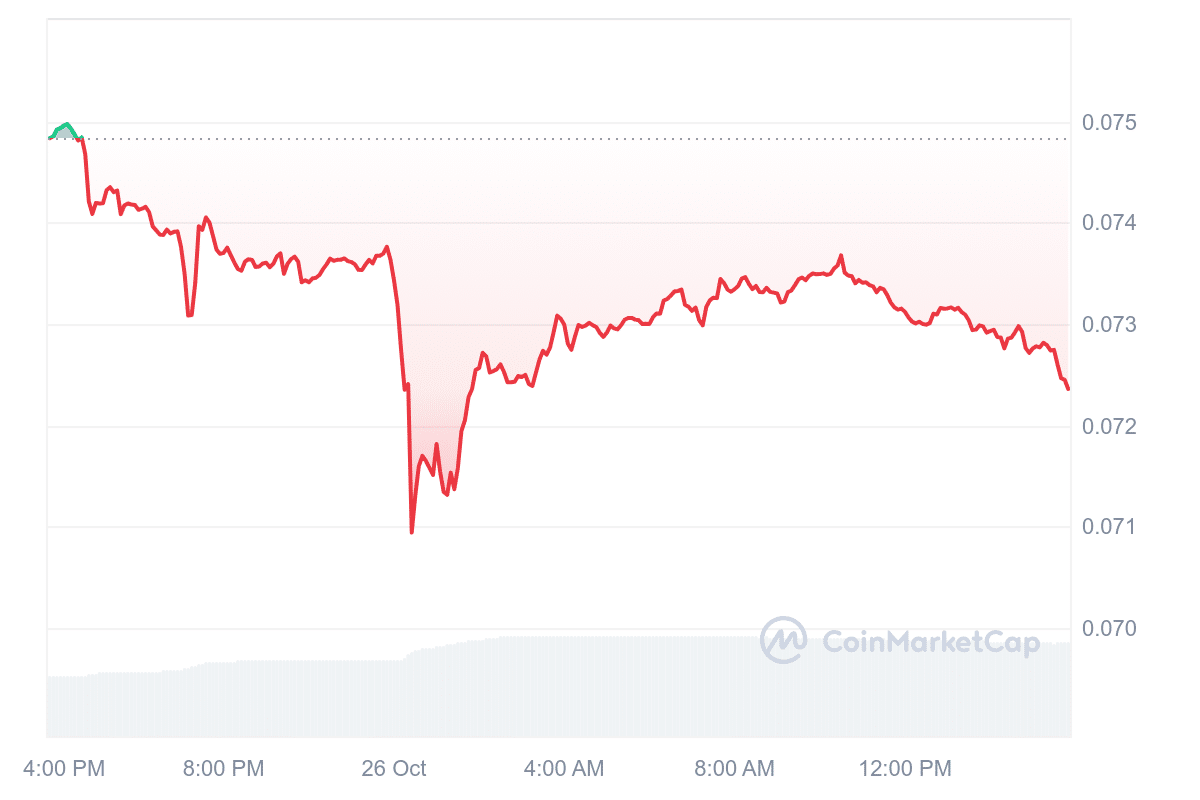

At press time, the value of CRO is $0.07234, reflecting a 3.32% intraday lower. Market capitalization has additionally dropped by the identical charge, touchdown at round $1.92 billion. Nonetheless, buying and selling exercise has surged, with a 54.32% enhance in quantity, reaching $7.71 million.

This uptick in quantity might point out rising curiosity or heightened market exercise regardless of the latest value drop. Moreover, Cronos has a completely diluted valuation (FDV) of $2.17 billion, and its volume-to-market cap ratio is 0.4109%, suggesting reasonable buying and selling curiosity in relation to its market measurement.

Pyth, a number one oracle protocol on #Cronos EVM and zkEVM, pronounces Redemption Fee Feeds (RRF) that monitor the rewards collected by yield-bearing tokens. $CDCETH, on Cronos EVM chain, is without doubt one of the few main tasks built-in for the inauguration of this function! https://t.co/0Bh3fYUZjS

— Cronos (@cronos_chain) October 26, 2024

Current value actions present minor fluctuations, with a low of $0.0722 and a excessive of $0.07333, indicating some short-term volatility. In the meantime, the CoinMarketCap group sentiment stays usually optimistic, with 85% of voters expressing optimism about Cronos. This optimism suggests confidence in Cronos’s targets and potential, even with latest value shifts.

3. Injective (INJ)

The proposed collaboration between Injective and Fetch.AI, a blockchain AI protocol, has drawn consideration throughout the crypto group. A crypto analyst from the Altcoin Buzz podcast thinks this partnership might give Injective a short-term enhance, doubtlessly pushing the value up.

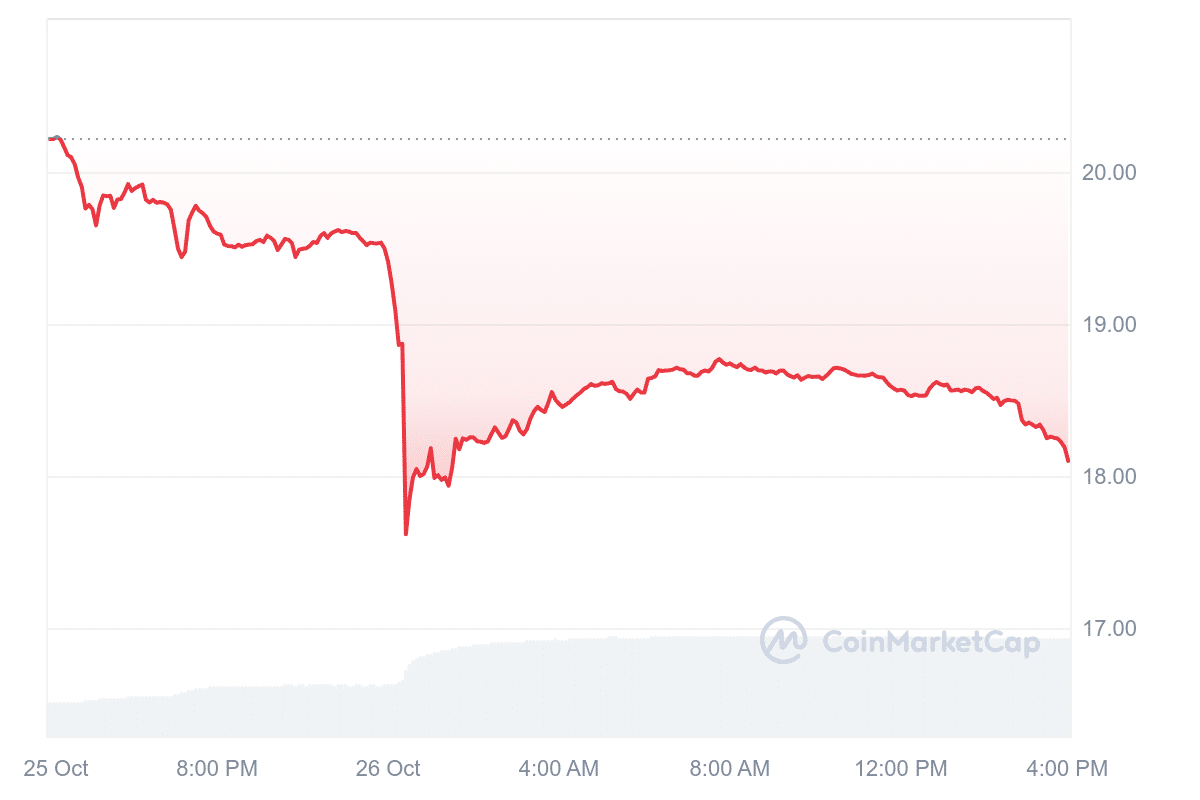

On the time of writing, the INJ token’s value dropped to $18.08, down 10.60% over 24 hours, with its market cap additionally down by 10.63%. Buying and selling quantity has surged by 174.33% to $140.87 million throughout the identical interval, probably as a result of investor reactions to the value dip.

Injective’s totally diluted valuation (FDV) is close to $1.81 billion, and its volume-to-market cap ratio sits at 7.68%, indicating excessive buying and selling exercise relative to its market measurement. Worth motion has been unstable, with INJ dropping from round $20 to $18 just lately.

The official on-chain governance proposal to combine Fetch and Injective is now dwell 🔥

100% of contributors have voted Sure to this point, marking one of many highest approval charges in historical past.$ASI + $INJ incoming 👀 https://t.co/ZdkNlnAhEF

— Injective 🥷 (@injective) October 24, 2024

In the meantime, market sentiment stays largely optimistic. This displays optimistic expectations from the bulk, regardless of latest fluctuations, probably pushed by pleasure surrounding the potential Fetch.AI partnership.

4. Memebet (MEMEBET)

Memebet has attracted over $525,000 in its presale, drawing curiosity from crypto buyers with its MEMEBET token. The on line casino, based mostly on Telegram, is geared toward crypto and meme coin lovers, mixing conventional sports activities betting with well-liked meme cash like Pepe, Dogecoin, Shiba Inu, and Bonk for putting bets.

Utilizing blockchain expertise, Memebet goals to make sure sooner transactions than conventional banking. Customers solely want a cryptocurrency pockets to entry the platform, avoiding KYC verification and account setup. This setup provides a less complicated and extra personal expertise for customers.

MEMEBET tokens at present value $0.0261, and gamers can use meme cash to put bets on video games, slots, and sports activities choices throughout the on line casino. Because the presale nears its subsequent funding milestone, the token value might quickly enhance, including urgency for buyers.

To encourage betting, Memebet has allotted 400 million MEMEBET tokens for airdrops, rewarding customers based mostly on their exercise. Greater-stakes bettors stand to learn most, although common customers even have future alternatives for these airdrops. Memebet’s mixture of meme cash and crypto betting creates a novel area of interest, interesting to these eager about each Web3 and decentralized gaming.

Go to Memebet Presale

5. Solana (SOL)

Solana is an open-source blockchain undertaking geared toward offering decentralized finance (DeFi) options via a permissionless community. Solana’s standout function is its speedy transaction processing capabilities.

The blockchain employs a hybrid protocol that optimizes validation occasions for transactions and good contract executions, considerably enhancing its pace and scalability. These efficiencies have attracted curiosity from institutional gamers, positioning Solana as a distinguished blockchain for high-speed purposes throughout the crypto market.

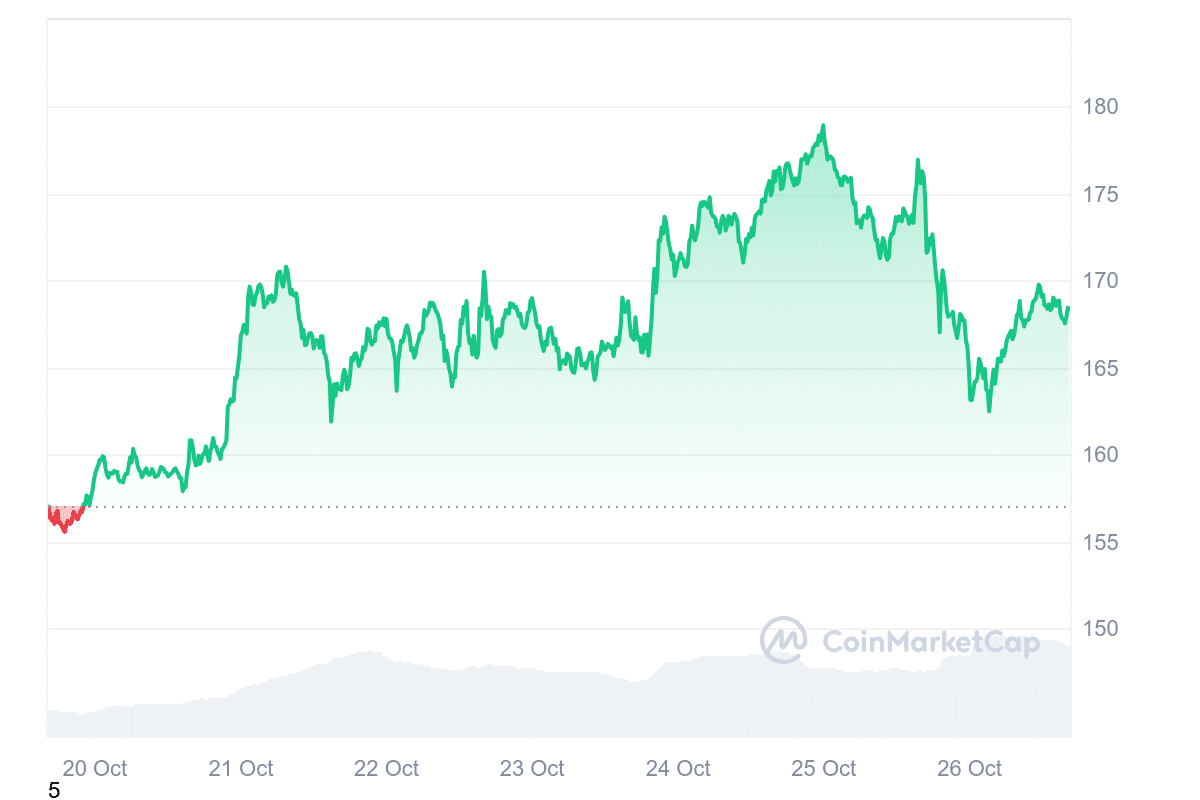

At present, SOL is valued at $168.24, marking a 7.17% enhance over the previous week. Its market cap is $79.11 billion, down 4.55% regardless of heightened buying and selling curiosity. Notably, the previous 24 hours noticed a buying and selling quantity of $4.63 billion, a 38.48% enhance, indicating sturdy latest engagement with the token.

It’s a phenomenal day to learn the State of Solana: Breakpoint Version ☀️

– $3.8B stablecoins issued on the community.

– $173M capital raised by founders, Q3’24.

– 78 DePIN merchandise constructed on Solana.Try the total report — share your favourite takeaways!https://t.co/iQtXZRp5oc

— Solana (@solana) October 22, 2024

General sentiment throughout the group stays optimistic, reflecting common optimism regardless of some fluctuations in Solana’s market cap. Solana’s volume-to-market cap ratio of 5.90% indicators excessive buying and selling exercise relative to its market measurement.

Out of a complete provide of 587.26 million SOL tokens, round 470.20 million are at present circulating. Worth traits point out a gradual upward trajectory, just lately nearing $180 earlier than stabilizing on the present $168 vary.

Learn Extra

Most Searched Crypto Launch – Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured in Cointelegraph

- SolidProof & Coinsult Audited

- Staking Rewards – pepeunchained.com

- $10+ Million Raised at ICO – Ends Quickly

Be part of Our Telegram channel to remain updated on breaking information protection