The world’s largest company holder of Bitcoin, MicroStrategy, could also be angling to compete with the lately launched bevy of Bitcoin ETFs. In a latest webinar, firm co-founder Michael Saylor mentioned the agency was pivoting to a Bitcoin improvement technique.

The transfer might be a manner for the agency to compete with buyers within the enviornment of exchange-traded funds. However how do the 2 stack up?

MicroStrategy Turning into BTC Growth Firm

In its fourth-quarter earnings webinar on February 6, Saylor mentioned

“We view ourselves as a Bitcoin improvement firm. Which means we’re going to do every part we are able to to develop the Bitcoin community.”

He additionally mentioned the agency will purchase extra BTC and do every part it could actually to learn the shareholders.

The slide Saylor was commenting on gave a comparability between MicroStrategy and spot Bitcoin exchange-traded merchandise.

It provided 4 “distinctive strengths” evaluating firm construction, noting that it was an working firm with lively management over capital construction and no administration charges. Comparatively, spot ETFs had been operated with a belief firm that has restricted management and administration charges.

The flexibility to develop software program, generate money from operations, and leverage capital markets had been the opposite three traits that MicroStrategy has and spot ETFs lack.

Learn extra: Bitcoin Worth Prediction 2024/2025/2030

On February 8, ETF Retailer President Nate Geraci noticed:

“MicroStrategy making an attempt to place as a superior different to identify bitcoin ETFs”

He added that there have been “meaningfully totally different dangers concerned” which weren’t outlined. He additionally talked about that MicroStrategy inventory was down 20% year-to-date whereas Bitcoin had gained 4%.

MSTR vs. BTC ETFs

However, MSTR inventory has carried out properly over the previous 12 months, gaining 88%. It posted a yearly excessive of $685 on January 2 however has cooled off since.

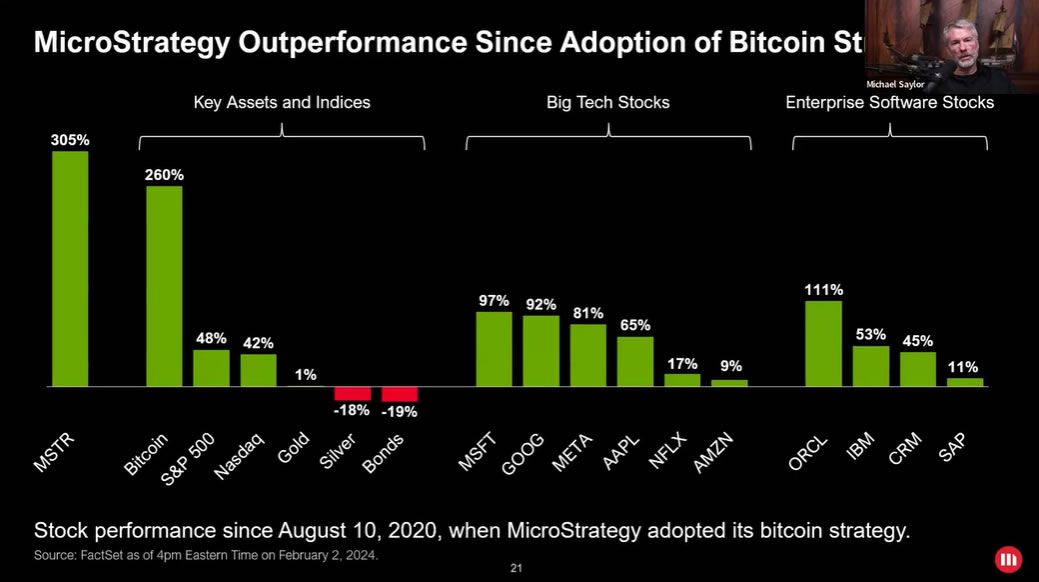

Nonetheless, because the agency adopted its Bitcoin technique in 2020, share costs have outperformed US inventory indexes, commodities, and even crypto markets themselves.

Spot Bitcoin ETFs are nonetheless of their infancy, having solely traded for 4 weeks. However, other than Grayscale, it acquired 187,000 BTC in that interval and is near eclipsing Microstategy’s holdings of 190,000 cash.

Bitcoin ETFs are anticipated to carry out properly in 2024 because the crypto market enters a bull section catalyzed by the BTC halving occasion in April.

Nonetheless, that can be excellent news for MicroStrategy, which is already up 41.6% on its whole BTC purchases, in keeping with Saylor Tracker.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.