The latest Bitcoin worth motion has sparked combined reactions amongst traders, however on-chain metrics recommend the market nonetheless has room to develop.

Bitcoin hit an all-time excessive of $109,110 this week however has since dropped to $101,257. Whereas it has rebounded, the repeated cycle of fluctuations and recoveries continues to create uncertainty amongst market members in regards to the present bull season. Some have even advised that the market prime could also be in.

Nonetheless, Bitcoin’s on-chain information signifies that there’s nonetheless potential for development earlier than it enters overbought territory.

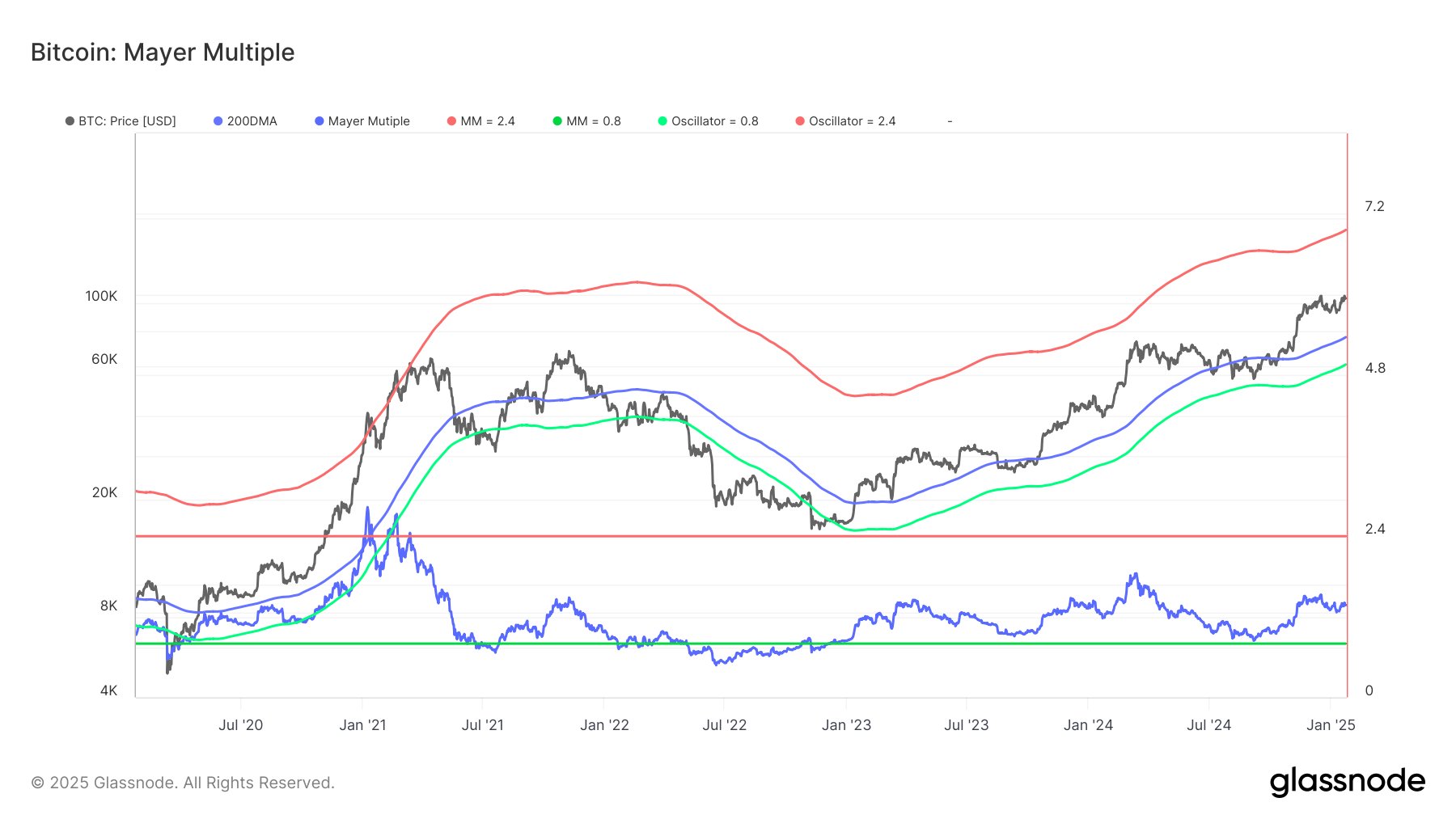

Particularly, the Mayer A number of (MM), a key indicator for assessing Bitcoin’s worth relative to its 200-day shifting common (200DMA), presents vital insights into the present bull market trajectory.

Understanding the Bitcoin Mayer A number of

The Mayer A number of is calculated by dividing Bitcoin’s worth by its 200DMA and has traditionally been used to establish key moments in Bitcoin’s market cycles. MM values above 2.4 sign overbought circumstances, whereas values beneath 0.8 point out oversold ranges.

Based on the analytics platform Glassnode, these metrics have confirmed dependable indicators of worth extremes, serving to traders navigate macro traits.

At the moment, Glassnode’s information exhibits Bitcoin’s Mayer A number of at 1.37. Which means that whereas its worth is 37% above its 200DMA, it’s nonetheless effectively beneath the overbought threshold.

Notably, Bitcoin will enter the overbought zone when its worth exceeds $181K—almost 74% greater than its present worth of $104K.

Room for Bitcoin to Rally to $181K

Basically, regardless of Bitcoin buying and selling above $100K, its uptrend stays removed from overheating.

Notably, Bitcoin’s oversold threshold is at $60K, offering a security margin within the occasion of a market correction. For context, reaching this stage would require Bitcoin’s worth to drop by 42% from its present worth.

Moreover, the MM’s neutrality at 1.0 aligns with a $75K worth, indicating a robust assist stage for the continuing rally.

With the overbought threshold nonetheless distant, traders stay optimistic about Bitcoin’s capability to scale new heights within the months forward. An earlier evaluation by The Crypto Fundamental suggests the market nonetheless has a window of as much as 250 days earlier than the bull market might formally come to an finish.

Finally, technical information factors to the Bitcoin bull market remaining intact, with $181K serving as the subsequent key milestone for traders to look at.

DisClamier: This content material is informational and shouldn’t be thought of monetary recommendation. The views expressed on this article might embrace the creator’s private opinions and don’t replicate The Crypto Fundamental opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Fundamental just isn’t chargeable for any monetary losses.