The Bitcoin (BTC) worth has constantly traded throughout the $67,000 and $68,000 vary for a number of days. On this evaluation, BeInCrypto goals to know the value motion of Bitcoin.

Moreover, now we have noticed a decline in volatility, which will be attributed to numerous components. To offer a complete evaluation, we’ll discover who’s shopping for and promoting Bitcoin.

Analyzing Bitcoin Exercise and Vaulting Charges

The chart beneath illustrates the exercise fee and vaulting fee of Bitcoin over time, together with its worth in USD. Listed here are the important thing observations from the chart:

Exercise Price (proven in crimson):

The Exercise Price exhibits how a lot Bitcoin is actively traded or moved by customers, indicating how usually folks use or switch their BTC.

Notable spikes and drops point out intervals of elevated and decreased exercise amongst Bitcoin holders. Vital fluctuations will be noticed, significantly round key worth actions. We’ve noticed an interesting drop within the exercise fee, from 9% to -3%. This lower in exercise might point out a pattern in the direction of long-term holding of Bitcoin.

Vaulting Price (proven in inexperienced):

The Vaulting Price exhibits how a lot Bitcoin customers are shifting into long-term storage, holding it secure for the long run (Vaulted Provide represents the proportion of Bitcoin that has been vaulted or has by no means been bought since its first acquisition).

Optimistic vaulting charges recommend that traders are shifting extra BTC into long-term storage. The chart exhibits intervals the place the vaulting fee will increase, doubtlessly indicating holders’ confidence within the asset’s future worth.

Learn extra: Who Owns the Most Bitcoin in 2024?

The decline in exercise and the rise in vaultedness might clarify the lowering volatility pattern.

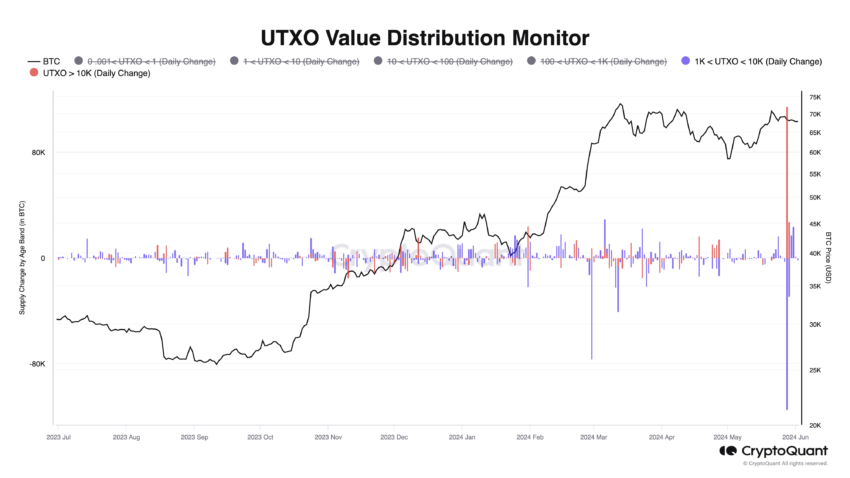

Understanding the UTXO Worth Distribution Monitor

The UTXO (Unspent Transaction Output) Worth Distribution Monitor analyzes BTC transactions primarily based on the worth of BTC held in several wallets. Let’s break it down in easy phrases and clarify what this indicator tells us.

What’s UTXO?

UTXO stands for Unspent Transaction Output. It refers back to the quantity of Bitcoin obtained after a transaction that can be utilized in future transactions. In essence, UTXOs outline the place every blockchain transaction begins and finishes.

What Does the UTXO Worth Distribution Monitor Present?

The coloured bars characterize each day modifications within the quantity of BTC held in several UTXO worth bands:

- Purple Bars: Adjustments in UTXOs holding greater than 10,000 BTC.

- Violet Bars: Adjustments in UTXOs holding between 1,000 and 10,000 BTC.

What Does This Indicator Inform Us?

The UTXO Worth Distribution Monitor helps us perceive the conduct of BTC holders, from small traders to giant whales (very giant holders). Right here’s what it could actually inform us:

Accumulation and Distribution:

Optimistic modifications imply extra BTC stays in that worth band. For instance, if the crimson bars (10,000+ BTC) are constructive, giant holders accumulate extra BTC.

Damaging modifications point out that BTC strikes out of that worth band. So, if the blue bars (1,000 – 10,000 BTC) are damaging, mid-range holders promote their BTC.

Market Sentiment:

If giant holders (10,000+ BTC) accumulate, it suggests they’ve long-term confidence in Bitcoin’s worth.

If mid-range holders (1,000 – 10,000 BTC) are promoting, they is perhaps taking earnings or reallocating their belongings.

Market Dynamics:

The interplay between totally different worth bands can point out broader market traits. For instance, if we see 1,000 – 10,000 BTC holders promoting and 10,000+ BTC holders shopping for, it means that the market’s massive gamers are assured in Bitcoin’s future at present costs, even when smaller gamers are much less sure.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

In abstract, Bitcoin’s worth stability throughout the $67,000 to $68,000 vary, coupled with declining volatility, suggests a maturing market. The drop within the exercise fee and the rise within the vaulting fee point out a shift in the direction of long-term holding, reflecting elevated confidence amongst main holders.

The UTXO Worth Distribution Monitor additional helps this, exhibiting giant holders accumulating BTC whereas mid-range holders promoting. These traits level to a market the place massive gamers are optimistic about Bitcoin’s future, reinforcing its potential as a long-term funding.

Disclaimer

According to the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.