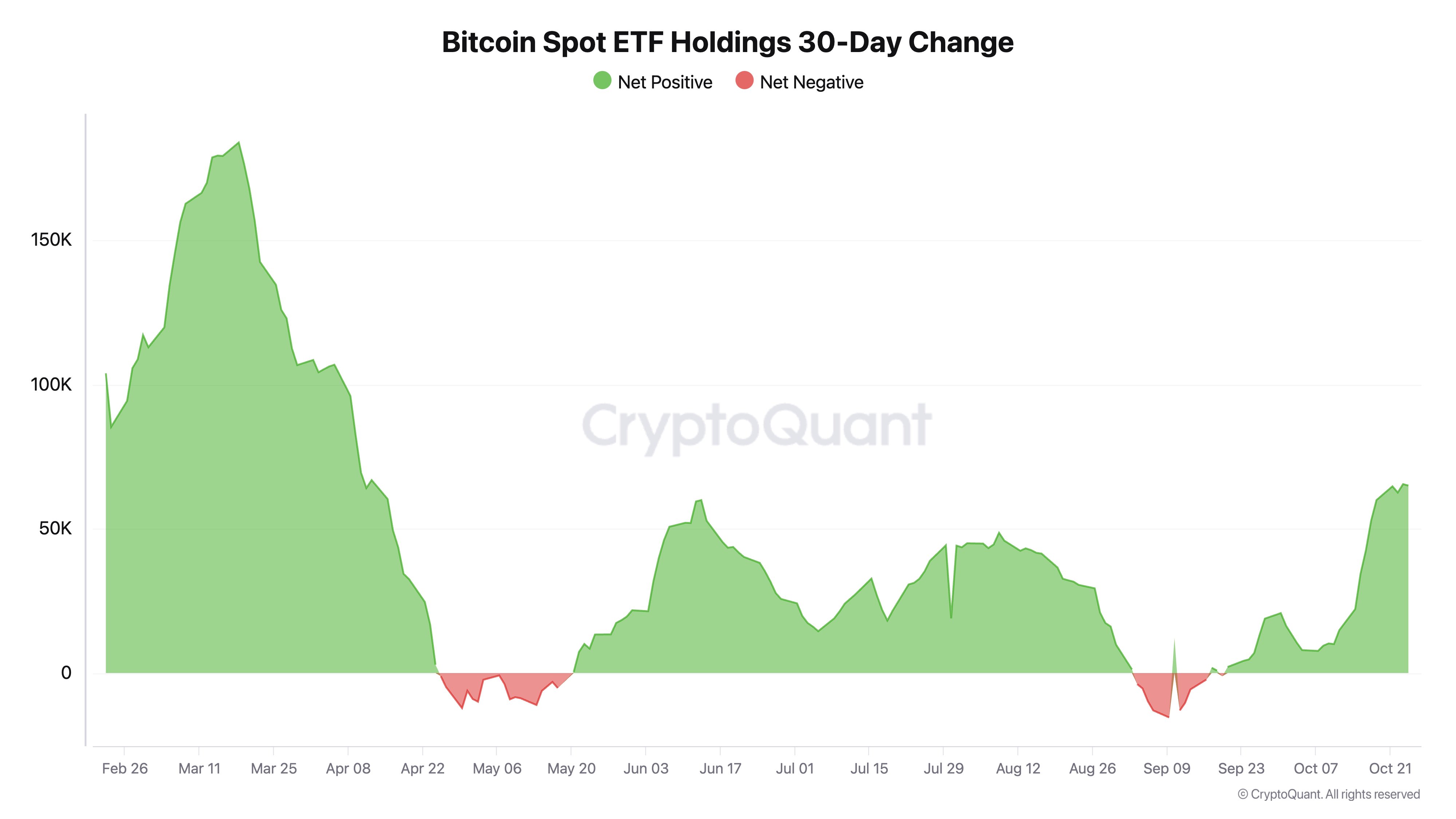

Demand for U.S. spot Bitcoin ETFs has reached its highest stage in six months, with web inflows totaling 64,962 BTC over the previous 30 days.

Ki Younger Ju, the founding father of CryptoQuant, highlighted this important pattern in a put up on X right now. This surge signifies that the U.S. Bitcoin ETF market has seen a exceptional $4.39 billion in new capital over the previous month.

The final comparable report was famous in April when Bitcoin traded above $72,000. The following bearish pattern in Bitcoin’s worth efficiency was additionally mirrored in ETF flows.

Particularly, spot Bitcoin ETFs skilled a decline in holdings for many of Could, coinciding with Bitcoin’s preliminary retracement beneath $56,000. Nonetheless, this pattern rapidly reversed, with constructive inflows reaching month-to-month highs from June to August earlier than one other downturn started in early September.

This bearish pattern shifted on September 18, when the U.S. economic system welcomed a historic rate of interest reduce, making investments in crypto property extra enticing. Since then, the constructive influx to Bitcoin ETFs has continued, not too long ago reaching a six-month excessive.

The large uptick in ETF holdings confirms renewed curiosity from institutional buyers, with market members hopeful that this might catalyze additional worth positive factors.

Bitcoin Value and ETF Calls for

Throughout this era, Bitcoin’s worth surged by 20%, rising from round $57,000 to just under $70,000. On Monday, when Bitcoin reached $69,500, Bitcoin ETFs noticed web inflows of $294.3 million, with BlackRock’s IBIT experiencing a large constructive circulation of $329 million.

Different ETFs, such because the Bitwise Bitcoin ETF, recorded detrimental flows of $22.1 million, whereas Ark Make investments’s ETF noticed a decline of $6.1 million. The Invesco Galaxy Bitcoin ETF and Franklin Bitcoin ETF had no new inflows.

Regardless of the crypto market shedding some bullish momentum, as evidenced by Bitcoin’s ongoing correction, the pattern of inflows to Bitcoin ETFs stays constructive.

As of Thursday, the U.S. market recorded $188 million in web inflows, led by BlackRock’s $165.5 million and Constancy’s $29.6 million. Different funds posted no new investments, whereas Grayscale skilled a drain of $7.1 million.

Moreover, a web circulation of $192 million was noticed on Wednesday. A detrimental pattern was recorded on Tuesday, coinciding with Bitcoin’s drop to $65,000. Cumulatively, U.S. Bitcoin ETFs have seen $21.6 billion in inflows since January, making it the fastest-growing ETF market on this decade.

DisClamier: This content material is informational and shouldn’t be thought-about monetary recommendation. The views expressed on this article could embrace the writer’s private opinions and don’t replicate The Crypto Primary opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Primary will not be chargeable for any monetary losses.