Historic context

Satoshi Nakamoto, a mysterious determine, launched Bitcoin 15 years in the past with the assistance of a small group. In early 2009, Nakamoto launched the Bitcoin software program and communicated with customers through e mail, by no means by telephone or in individual. Because the know-how gained consideration in 2011, Nakamoto disappeared, forsaking rising hypothesis and intrigue.

Australian laptop scientist Craig Wright has claimed to be Nakamoto since 2016, sparking disputes and lawsuits. Testifying in opposition to Wright have been Adam Again, Mike Hearn, Martti Malmi and Zooko Wilcox-O’Hearn, all contributors to Bitcoin’s early improvement.

Adam Again developed Hashcash, which turned the bottom for Bitcoin’s mining course of. Martti Malmi managed Bitcoin.org, Mike Hearn contributed code, and Zooko Wilcox-O’Hearn promoted Bitcoin via running a blog.

Lately, 120 pages of correspondence between Satoshi Nakamoto and his early collaborator Martti Malmi was launched publicly as a part of a lawsuit. These emails, out there on GitHub, present new avenues for analysis and supply perception into Nakamoto’s character in addition to Bitcoin’s essential points.

Belief is every little thing

In keeping with Nakamoto, the basic concern with conventional forex is the necessity for belief in centralized establishments like central banks and banks, which regularly breach that belief via forex devaluation and dangerous lending practices. Moreover, these establishments require belief with our privateness and monetary safety, making micropayments tough as a result of excessive overhead prices.

Nakamoto compares this to the belief required in early laptop methods earlier than robust encryption, the place customers relied on system directors to guard their privateness. Nonetheless, with the arrival of robust encryption, belief turned pointless as knowledge may very well be secured from unauthorized entry.

Likewise, Nakamoto argues for the same answer for cash with e-currency primarily based on cryptographic proof. This eliminates the necessity for belief in third-party intermediaries, guaranteeing safety and easy transactions.

Anonymity points

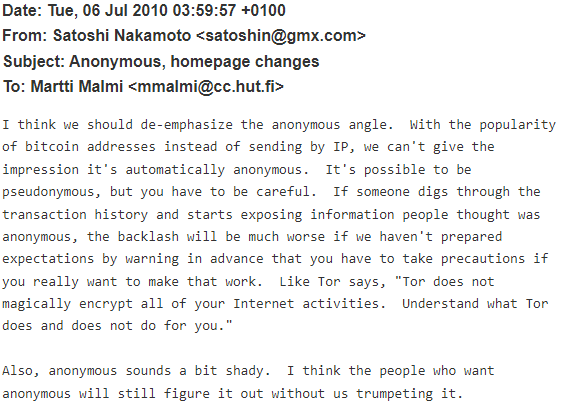

Nakamoto acknowledged early on that Bitcoin was not totally nameless. Whereas it may very well be pseudonymous with correct precautions, sustaining privateness was difficult. He suggested in opposition to emphasizing anonymity to stop deceptive customers and recommended customers rigorously think about privateness implications.

Nakamoto contemplated describing Bitcoin as non-public however acknowledged the necessity to keep away from deceptive customers or fostering mistrust. He recommended de-emphasizing the nameless facet, believing that those that want anonymity would perceive it with out specific promotion.

Power consumption

One key perception from Nakamoto’s correspondence is his consciousness of Bitcoin’s power consumption as a result of its proof-of-work (PoW) consensus mechanism. Whereas PoW is important for safety, it requires important computing energy, elevating environmental issues.

Nakamoto acknowledged these issues however argued that conventional banking methods’ inefficiencies far outweigh Bitcoin’s power use. He envisioned Bitcoin changing resource-intensive infrastructure and billions of {dollars} in banking charges with a extra environment friendly system.

He emphasised Bitcoin’s potential to be really peer-to-peer and not using a trusted third get together, in contrast to centralized digital cash makes an attempt. Nakamoto believed that even when Bitcoin consumed important power, it could nonetheless be much less wasteful than standard banking actions it aimed to switch.

Bitcoin scaling

Nakamoto expressed confidence in Bitcoin’s scalability, asserting that it might surpass present fee networks like Visa in transaction capability. He believed Moore’s Legislation would make sure the community’s capacity to deal with progress, contradicting frequent criticisms immediately.

Nakamoto highlighted Bitcoin’s potential to scale a lot bigger than Visa’s community with present {hardware} and at a fraction of the price. He emphasised that Bitcoin’s scalability wouldn’t hit a ceiling and mentioned the way it might deal with excessive dimension. He additionally anticipated that {hardware} pace developments would outpace transaction progress, even below speedy adoption charges.

Safety

Nakamoto emphasised the safety of the Bitcoin community, stating that its robustness will increase with community progress. He acknowledged preliminary vulnerabilities however argued that the community’s design inherently discourages theft via its financial mannequin.

Nakamoto highlighted that Bitcoin’s safety grows alongside its dimension and the worth it protects. Whereas acknowledging preliminary vulnerability when the community is small, he famous that the trouble required to steal outweighs potential beneficial properties.

“A key facet of Bitcoin is that the safety of the community grows as the scale of the community and the quantity of worth that must be protected grows,” Nakamoto writes. “The down aspect is that it is weak originally when it is small, though the worth that may very well be stolen ought to all the time be smaller than the quantity of effort required to steal it. If somebody has different motives to show some extent, they’re going to simply be proving some extent I already concede.”

For authorized causes, not funding

In Bitcoin’s early days, it was the one cryptocurrency acknowledged as a commodity by U.S. regulators as a result of its decentralized nature. Nakamoto, conscious of U.S. rules, prevented selling Bitcoin as an funding, preferring customers to come back to that conclusion independently.

“I might be stunned if 10 years from now we’re not utilizing digital forex in a roundabout way, now that we all know a option to do it that will not inevitably get dumbed down when the trusted third get together will get chilly ft,” he writes in certainly one of his emails.

Future use circumstances

Nakamoto offers his early ideas on methods of the know-how’s attainable implantation within the present monetary system. In one of many emails, he introduces the idea of promoting paysafecards for Bitcoins, both via on-line supply or bodily supply. These playing cards, often known as Reward Playing cards in some international locations, are sometimes utilized by people with out credit score historical past to pay for objects that require a bank card.

In a while, Nakamoto offers some concepts for potential use circumstances:

- Think about positioning it as an intermediate credit score for micropayments for digital items.

- Discover the idea of one-way funds the place solely shopping for Bitcoins and sending cash out may very well be useful for pegging the forex.

- Cost for laptop time may very well be one other potential use case.

- Keep away from discussing the thought of returning cash to prospects’ bank cards, as bank card firms typically disapprove.

- Any fee processor will possible require you to promote one thing tangible.

One of many key fragments offers an important level in understanding cryptocurrencies’ novelty versus fiat cash.

Not like conventional commodities, Nakamoto claims, digital currencies like Bitcoin supply the opportunity of buying and selling over the web with out counting on trusted intermediaries.

![Decoding the Genesis of NFTs: Robert Alice’s “SOURCE [On NFTs]” | NFT CULTURE | NFT Information | Web3 Tradition Decoding the Genesis of NFTs: Robert Alice’s “SOURCE [On NFTs]” | NFT CULTURE | NFT Information | Web3 Tradition](https://i3.wp.com/www.nftculture.com/wp-content/uploads/2024/03/Robert-Alice-Christies-1024x698.png?w=150&resize=150,150&ssl=1)