Bitcoin’s (BTC) incapability to commerce above sure worth ranges for over per week may spell larger points for the flagship cryptocurrency. These struggles have raised legitimate considerations as bearish sentiment continues to achieve traction whereas market volatility intensifies.

Seven days in the past, Bitcoin tried to retest $60,000. Nevertheless, it confronted rejection and has since been unable to achieve the area. The next is what should occur for Bitcoin to keep away from a market collapse worse than that of August 5.

BTC Survival Hangs within the Stability

In line with Glassnode, Bitcoin worth has fallen beneath the Quick-Time period Holders (STH) Realized Value. For context, the STH-Realized Value tracks the typical on-chain price for BTC that was moved inside the final 155 days. As a result of the metric exhibits if holders are in unrealized income or losses, it’s essential to judge the worth potential.

As of this writing, the STH Realized Value is $62,443, and it has been above Bitcoin’s spot worth since August 25.

Usually, if the spot worth falls beneath the STH Realized Value for an prolonged interval, it may very well be an indication of a attainable bear market. Subsequently, it isn’t misplaced to say that Bitcoin dangers a steeper worth correction until it rises above $62,443.

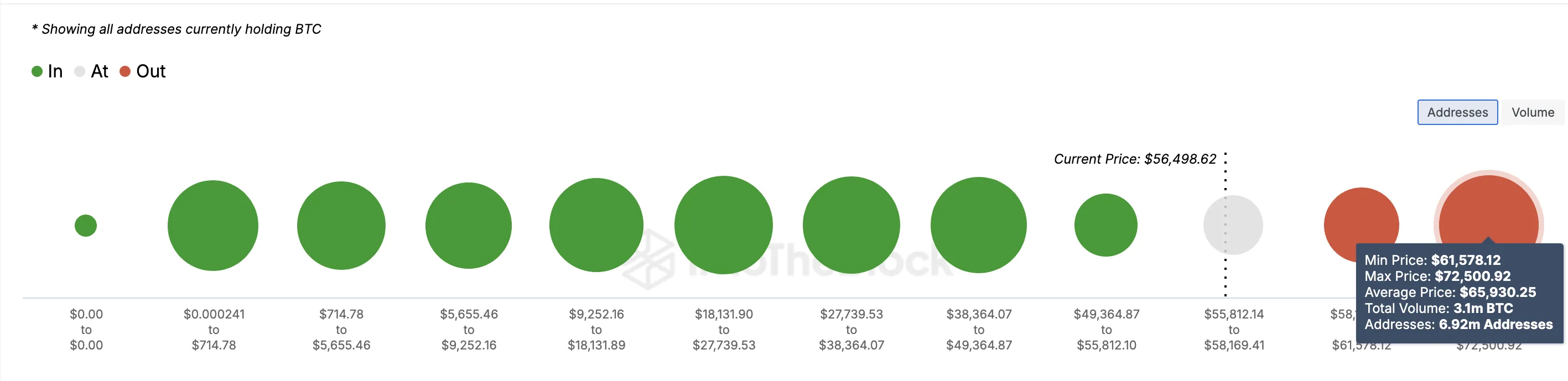

Moreover this on-chain price foundation, the International In/Out of Cash indicator (GIOM) exhibits that Bitcoin may face important resistance between $61,578 and $72,500 if the worth makes an attempt to achieve these ranges. Right here, 6.92 million addresses collected 3.1 million BTC.

This determine is rather a lot increased than the variety of addresses that bought the cryptocurrency at a mean worth of $52,516.

Learn extra: Pepe: How To Purchase Bitcoin (BTC) on eToro: A Step-by-Step Information

As such, if Bitcoin makes an attempt to surpass $61,000, the provision barrier may pull it again. If this occurs and demand fails to indicate up, Bitcoin’s worth dangers dropping to $49,364, the decrease acquisition threshold.

Bitcoin Value Prediction: Beneath $50,000

From a technical standpoint, the three-day Bitcoin chart confirms the bearish bias. Based mostly on the chart, BTC has shaped a megaphone prime sample, which seems when the worth hits three increased highs and two decrease lows.

Typically, this technical sample signifies a reversal from bullish to bearish. In circumstances the place a decline has been established, the downward development continues.

If validated, Bitcoin’s worth may drop by roughly 15% and attain $47,778 within the course of. At the moment, promoting strain seems stronger as evidently many market contributors are nonetheless on the sidelines. Ought to this stay the identical, a attainable drop beneath $50,000 may occur.

Learn extra: Pepe: 7 Finest Crypto Exchanges within the USA for Bitcoin (BTC) Buying and selling

Nevertheless, if BTC defies this development and reclaims $61,935, the prediction is likely to be invalidated. In that state of affairs, the cryptocurrency’s worth may get away and rally towards $71,453.

Disclaimer

In keeping with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.